This article is reprinted with permission from the Free State Foundation.

By Randolph J. May

Free State Foundation

The election last November of Maryland Gov. Larry Hogan was a welcome sign that Marylanders recognized that the state’s fiscal health was poor – the result of too much unrestrained spending leading to too much debt. The election confirmed that Maryland’s citizens wanted a change of direction.

Since he took office, Gov. Hogan already has taken some positive steps to improve Maryland’s budgetary situation – and he needs the help of the legislature to do more.

If a further spur were needed, now comes the newly-released study from George Mason University’s Mercatus Center titled, “Ranking the States by Fiscal Condition.” The study is authored by Eileen Norcross, the respected analyst who directs the Mercatus Centers State and Local Policy Project.

The new study ranks each U.S. state’s financial health based on short and long-term debt and other key fiscal obligations, including unfunded pensions and health care benefits. It builds on previous Mercatus research concerning each state’s fiscal condition. And it provides information from the states’ audited financial reports in an easily accessible format, presenting an accurate snapshot of each state’s fiscal health.

Sadly, Maryland ranks 37th among the 50 states for its fiscal health, based on its fiscal solvency in five separate categories. I urge you to look at the Maryland results set forth in more depth in the report. But here are the summary results for the five categories used to rank all the states:

- Maryland ranks 39th in terms of cash solvency

- Maryland ranks 44th in terms of budget solvency

- Maryland ranks 43rd in terms of long-run solvency

- Maryland ranks 11th in terms of service-level solvency

- Maryland ranks 17th in terms of trust fund solvency

Again, all told, Maryland’s overall ranking is 37th among the 50 states. (Perhaps not surprisingly, Illinois brings up the rear!)

Make no mistake whatever: Maryland is not Greece! But the new study does indicate that there is work to be done to improve Maryland’s fiscal health. Gov. Hogan, rightfully in my view, has vowed to hold the line against imposing new taxes, since Maryland already suffers from a reputation as a state with excessively high taxes. So it will be important, going forward, to restrain the rapid growth experienced in the last many years in the level of expenditures.

For the sake of future Marylanders, as a measure of its fiscal health, the state needs to do better than rank 37th!

Randolph May is the president of the Free State Foundation and can be reached at [email protected]

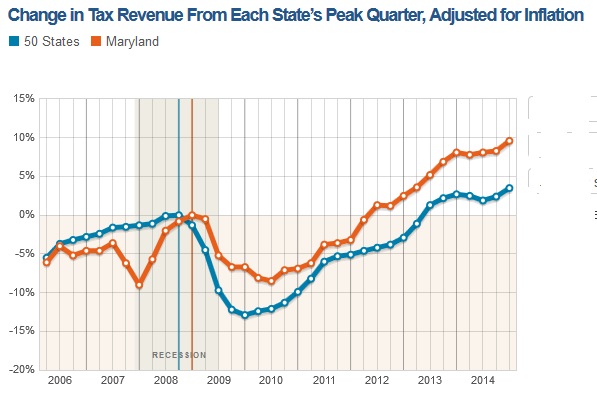

Editor’s Note: Mercatus Center has a free-market orientation. For further information about how Maryland compares on fiscal policy, the Pew Center for the States has some interactive charts and maps.

The Legislature, in particular,the Progressive/Radical Democrat members have to trim back their dreams since there isn’t enough money for them…

No more “structural deficits”… That is fiscal malfeasance ! Create a budget that lives within the monies received, just like we taxpayers… If you don’t have the money,you can’t afford it…

I support what Governor Hogan is doing.