By Ashley S. Westerman

Capital News Service

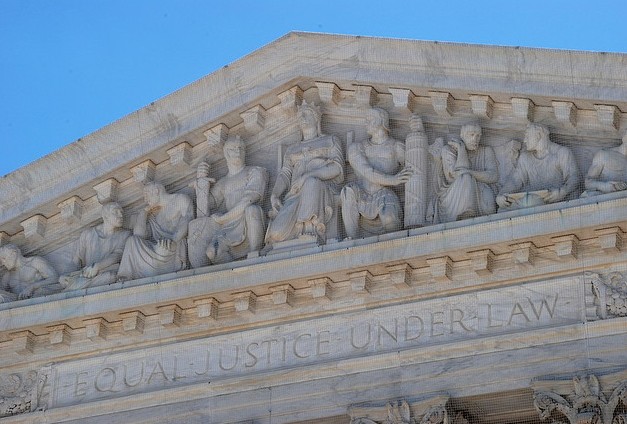

The U.S. Supreme Court is set to hear a case involving a Maryland couple who believe their out-of-state income should not be taxed by their state of residence.

Brian and Karen Wynne of Howard County argue the income they earn in several other states through Maxim Healthcare Services Inc., a company Mr. Wynne partially owns, should not be taxed by Maryland if they pay the income taxes in those other states.

Maryland has an out-of-state income tax credit that can be used to offset state income taxes. But there is no equivalent credit that can be used to offset county income taxes, so counties can tax the out-of-state income.

According to court documents, Comptroller of the Treasury of Maryland v. Wynne (No. 13-485) asks the question: “Does the United States Constitution prohibit a state from taxing all income of its residents — wherever earned — by mandating a credit for taxes paid on income in other states?”

The Wynnes argued in Maryland Tax Court that the partial credit violates the dormant Commerce Clause.

University of Maryland Carey School of Law Professor Mark Graber said the dormant Commerce Clause says “there are some state regulations of interstate commerce that are unconstitutional even when Congress does not act.”

“So there is no federal law that prohibits or requires states to give tax credits for taxes paid in other states,” Graber said. “But the claim the Wynnes are making is that, in fact, Maryland’s failure to do so sufficiently burdens interstate commerce.”

Maryland’s high court agreed with Wynnes

When the Maryland Tax Court sided with the comptroller, the Wynnes appealed to the Maryland Court of Appeals, the state’s highest court, which sided with them.

Dominic Perella, the Wynne’s counsel, said his client believes he “shouldn’t have to pay double taxes” and that the way Maryland structures its taxes punishes him for growing a successful business.

But Maryland has argued in court documents that, among other points, it has the right as a sovereign state to tax the entirety of its residents’ income, regardless of where the income was generated or if taxes on that income were paid in other states. The Maryland Attorney General’s office said it does not comment on pending litigation.

A brief filed by organizations representing local governments also contends that counties would suffer if they offered credits against county income tax for income earned out-of-state.

“There would be significant financial implications for counties,” said Andrea Mansfield, legislative director of the Maryland Association of Counties.

Significant cost to counties

According to the brief, if the Supreme Court sides with the Wynnes, estimates from the comptroller’s office are that it could cost local governments $120 million in retroactive refunds, and could reduce local income tax revenues by about $50 million annually going forward.

The Bureau of Revenue Estimates says the initial cost to local governments could actually be higher – $190 million plus interest in protected claims and retroactive refunds.

Graber said if that happens, the Maryland tax bill for all residents who earn out-of-state income will go down.

“Conversely, the revenue obtained by Maryland will also go down,” Graber said.

Business groups have sided with Wynne’s in their own briefs to the court, including the U.S. and Maryland Chambers of Commerce and the National Federation of Independent Business.

He said if the high court sides with Maryland, life will probably go on as usual as the Supreme Court has in the past left states alone to tax the income of their residents as they see fit.

The Supreme Court begins its next session Monday. This case is set to be argued Nov. 12.

Many people don’t understand the issue of whether income should be taxed at source (where earned) or the residence of the taxpayer. If all income were taxed based on residence, all the rich people would live in the Cayman Islands and pay no tax. ( This is the Google, Apple, Amazon approach) There has to be a balance and if income is taxed at source, then the residence jurisdiction has to give an appropriate credit for taxed paid at source.

For MD, there is no ability to use taxes paid at source against MD county income taxes. So for the income taxed at source and in MD counties, there is double tax.

I wouldn’t feel too sorry for this company, pay the tax.

Criminal and civil charges[edit]

Starting in 2009, Maxim and some of its employees came under government scrutiny for alleged fraudulent billings and false statements to health officials, which were “a common practice at Maxim from 2003 through 2009,” according to the U.S. Attorney’s office in New Jersey.[12] Between 2009 and 2011, nine current and former Maxim employees including three senior managers pleaded guilty to felony charges.[12] In 2011, Maxim entered into agreements with the United States Department of Justice and affected states to pay $150 million to resolve criminal and civil charges that the company submitted claims for millions of dollars of work that it did not perform and operated offices that were not properly licensed.[13] The Company entered into a Deferred Prosecution Agreement with the United States Attorney’s Office for the District of New Jersey, a Corporate Integrity Agreement with the Office of the Inspector General, U.S. Department of Health and Human Services, and civil settlement agreements with the United States of America and 43 states.[14]

So just how much taxpayer money is the Comptroller’s and Attorney General’s office wasting by taking this to the higher court? Why can’t Maryland take no for an answer? Why waste time and resources over one family’s income tax????

Time for a Republican sweep on every top office in the state!!!!!!!!!!

Perhaps you were unable to finish the article. Estimates of the loss to local governments are an initial $120 million and an ongoing $50 million per year. That’s why they are arguing about one family’s income tax.

I agree the concept is wrong. But the Supreme Court may draw an analogy to the U.S.’s ability to tax it’s overseas citizens on income earned in a foreign country and decide that the counties of Maryland have the same right.

It would appear the Wynne’s are asking for just that. We do get credit for foreign taxes paid. The counties are not giving such credit.

There’s been a lot of ink spilled over this case.

The state collects the counties’ piggyback taxes but that money is often not conveyed to counties in the year it is collected. Further, it appears the state’s collections of the piggyback taxes are not 100% remitted to the counties.

None of the legal arguments have made the arguments against the State associated with how the money flows back to the counties.