@BryanRenbaum

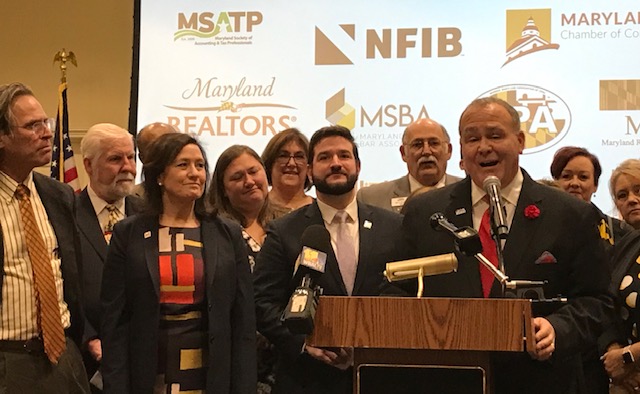

Business advocacy groups converged on Annapolis on Monday to protest legislation that would expand Maryland’s sales tax to services not currently taxed and raise an estimated $2.9 billion over the next five years to help fund the recommendations of the Kirwan Commission.

They spoke prior to a House Ways and Means Committee hearing on the legislation. The hearing began this afternoon at 1 EST. The bill does not as of yet have a Senate counterpart.

“It is a regressive tax on our state’s small businesses and their customers. Just one trip to the auto mechanic…will double what proponents say the annual cost to Maryland taxpayers will be,” Mike O’Halloran, state director, Maryland & Delaware National Federation of Independent Business (NFIB), said at a news conference at the Lowe House Office Building.

“Unfortunately, there is no shortage of rankings that put Maryland at the bottom when it comes to its tax and business climate. Our groups stand ready to help turn that around.”

Christine Ross, who is president and CEO of the Maryland Chamber of Commerce, said the legislation would hit small businesses especially hard.

“Taxing services of all kinds would result in numerous destructive consequences — including against small and emerging businesses. Small firms typically rely on outside services — legal and accounting for example — while larger companies can rely on in-house expertise that would provide these newly taxable services for no sales-tax cost.

“Small and emerging companies will have to incur additional costs just to do business and to implement new tax reporting mechanisms — which will further hamper their growth.”

The legislation would make Maryland’s businesses less competitive than businesses in neighboring states, Ross said. It would discourage in-state expansion and prevent businesses from relocating to Maryland, she argued. Ross said only three states have enacted comparable legislation: Hawaii, New Mexico and South Dakota.

Tom Hood, executive director and CEO of the Maryland Association of Certified Public Accountants, said his group is concerned about the proposed tax’s “cost and administrative burden.”

“As CPA’s what we are really upset about with this bill is the cost and administrative burden that this will place on businesses — especially when it gets to the intangible services like accounting, CPA’s, consulting, lawyers, engineering, etc. And so that complexity — makes this a really hard bill to implement… It’s so bad that five states actually tried passing this bill in recent history and had to repeal it.”

Tom Kunkel, who owns a marketing business in Harford County, said the legislation is emblematic of how the state treats small-business owners.

“I’ve been involved with the NFIB for several years now and every year I come down here and testify several times. And we’re just heaped upon with all these regulations and costs that hit our bottom line and make us be able to operate not as profitably — or in some cases reduce our workforce.”

Del. Eric Luedtke (D-Montgomery) is the lead sponsor of the legislation. MarylandReporter.com approached Luedtke for comment in the hallway outside the room where the news conference was taking place. Luedtke said he was not familiar with what was being discussed inside and did not wish to comment until after today’s hearing. At the hearing, Luedtke defended the legislation.

“As consumption has changed from goods to services, the amount of revenue that comes from the sales tax has not kept pace with the growth in the economy. And, as a result, the sales tax has become a less reliable source of revenue for the state of Maryland.”

Luedtke said that although there is strong opposition to the legislation, he believes he and his colleagues ultimately have the same goal.

“I think that most people in this room, even if they oppose this specific bill, would agree that fully funding our schools is essential. We need to make sure that every kid in the state of Maryland has access to a great education. I think this is one option — only one option — but an option for how we get there.”

The legislation would lower the state’s sales and use tax from 6 percent to 5 percent. The sales and use tax would be expanded to cover more than 80 services. They include work performed by barbers, lawyers, accountants, electricians, plumbers and mechanics.

HB1628-Sales and Use Tax-Rate Reduction and Services, would, according to its text, alter the “definitions of ‘”taxable price”‘ and ‘”taxable service”‘ for the purposes of certain provisions of law governing the sales and use tax to impose the tax on certain labors and services.” It would alter the “rate of the sales and use tax.” It would alter the “percentage of gross receipts from vending machine sales and from certain sales of dyed diesel fuel to which the sales and use tax is applied.” It would alter the “rate of the sales and use tax applied to certain charges made in connection with sales of alcoholic beverages.”

An email Gov. Larry Hogan’s office sent on Monday afternoon blasted the proposed tax. “This would be the largest tax increase in Maryland history and would have a devastating impact on working families, retirees, and small businesses,” the email said.

The email said it included messages sent to the governor from small-business owners, senior citizens and retirees who urged him to not allow the new tax to pass because the tax burden Marylanders is too high.

The email quoted the Republican governor as saying of the advocates for the tax: “They are pushing the largest tax increase in history that would destroy everything we’ve done for five years. It would destroy our economy. This one tax increase is higher than all 43 of the [former Gov. Martin] O’Malley tax increases added together. It’s not ever going to happen while I’m governor.

Recent Comments