Marylanders worried that talk of looming billion-dollar state deficits could lead to tax hikes got some reassuring words Wednesday from the Democratic governor and Senate president.

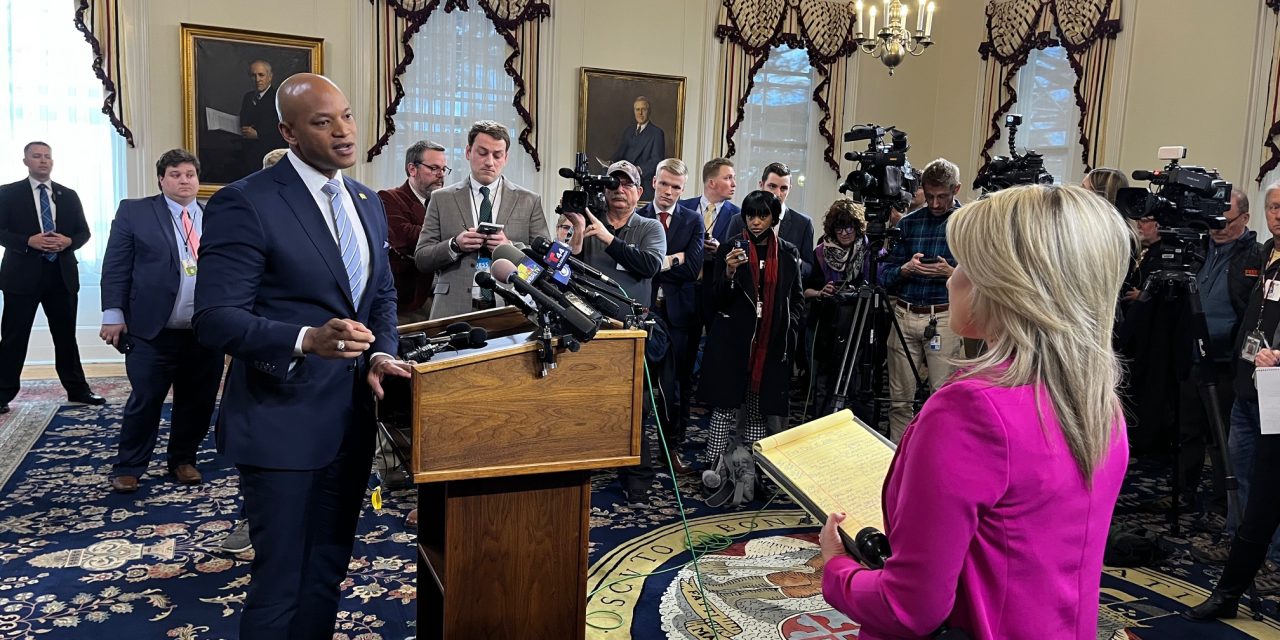

“Any conversation around taxes, people need to understand that my bar for that is very, very high,” Gov. Wes Moore told an unusually large crowd of reporters on hand for the first day of the legislative session. Moore was pressed by several questions on tax increases.

“The top priority that we have is making sure that we are modernizing government and being good stewards of taxpayer dollars… that we’re using every single dollar wisely, and we cannot grow the government, and we cannot grow our economy on the backs of working families.”

So what about fee increases? (There has been talk of higher fees for services like birth certificates, business filings and professional licenses.)

“I think we have to be disciplined. I think we have to be fiscally responsible. I think we have to do it in a way that we can actually get our economy growing, because our economy for the past five years has not been growing.”

That was the conclusion of a report last week prepared for the Maryland comptroller.

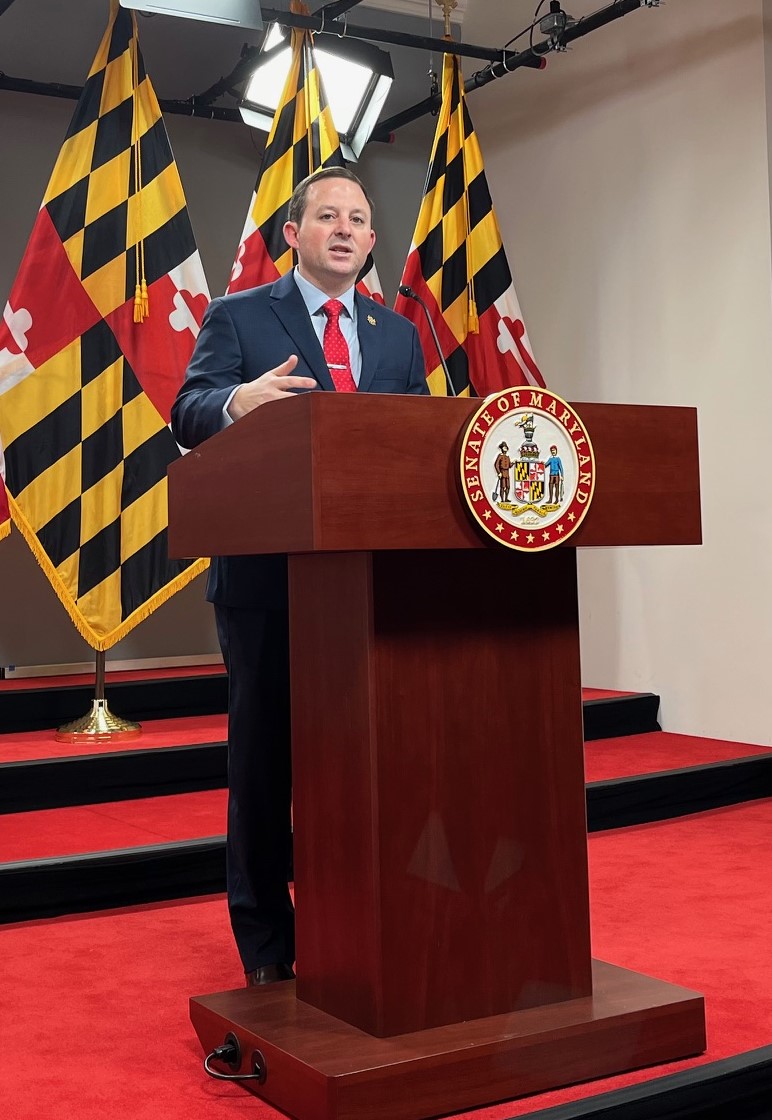

Senate President Bill Ferguson talks to reporters on the opening day of the General Assembly Wednesday. Maryland Reporter photo by Len Lazarick

An hour before the governor spoke, Senate President Bill Ferguson met with reporters. “I don’t see any need for wholesale tax increases in any way,” Ferguson said.

“Maryland provides more services than many other states. And so we are we have a more robust budget, but we have to be competitive. And so that’s something that’s really going to drive us. I think it’s more important that we look towards sharpening our pencils and maintaining [service] with the resources that we have this year.”

“This 2024 General Assembly session is really can be characterized as this is getting back to normal,” as the federal funds that flowed in during the pandemic have dried up.

“We stockpiled cash to make sure that we would be prepared either for a downturn or for situations like this where our revenues under-pace our expenditures. And so this is a year of tightening things up. As we look forward, this is also a year of trying to project places where we can trim on the edges for future costs.”

Ferguson recently returned from a meeting with 27 other state Senate presidents from the country where most of them were talking about cutting taxes.

“That’s not the position that we’re in, but we have to be very realistic and mindful of the context in which we are operating. If we are a place where our cost of doing business is higher and objectively that is the case, then we also have to say that we have the best services in the country.”

Moore and Ferguson sounded like they were ruling out broad tax hikes, but they did not specifically rule out some of the proposals for raising revenues from Fair Share Maryland, a broad coalition of unions and progressive groups advocating seven ways to “close tax loopholes” and raise taxes.

These seven proposals include changing the method of taxing corporate profits, though Maryland has a higher corporate tax rate than its neighbors, and increasing estate taxes, which are paid out of assets after someone dies.

Recent Comments