@BryanRenbaum

More economic relief is on the way for Maryland’s small businesses, Gov. Larry Hogan said Thursday.

The relief was announced the very day the state’s COVID-related hospitalizations reached 1,720-the highest to date since the beginning of the pandemic in mid-March.

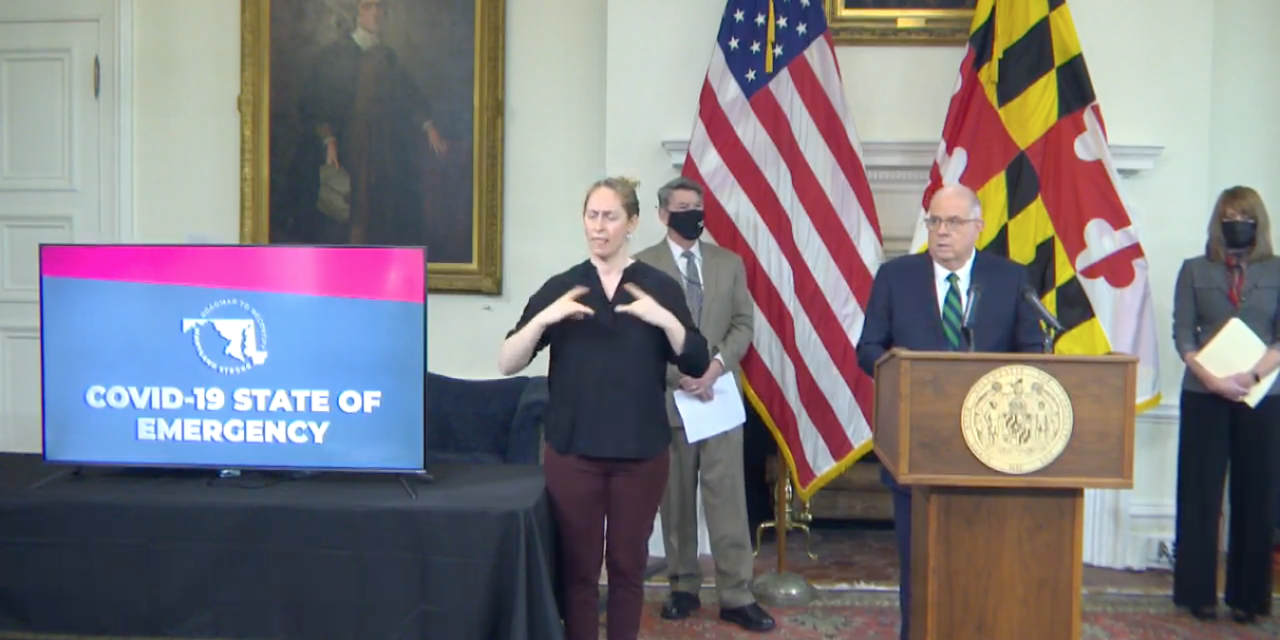

“Today I have signed an executive order to protect Maryland businesses from sudden or substantial increases in their unemployment taxes. This emergency relief will help more businesses keep their operations going and help keep more people on their payrolls,” Hogan said at a news conference at the State House in Annapolis.

Hogan added: “In March as part of our first round of state economic relief we provided $75 million in emergency loans to Maryland’s small businesses. Today I have directed the Department of Commerce to take immediate action to forgive the entire $75 million in emergency small business debt. These loans will be converted to grants which will not have to be paid back.”

Hogan also announced new investments in housing, health care and a variety of other areas:

- $25 million for “low-income housing tax credit projects” to “approve and promote the construction of 2,000 units of high-quality affordable housing”

- $12 million for the state’s Rental Housing Works Program

- $94 million in grants and investments for diabetes treatment

- $10 million for law enforcement, youth services victims services, PPE, testing supplies etc.

Business advocacy groups applauded the state’s decision to provide additional economic relief.

“We are continually grateful for the leadership of Governor Hogan and the Maryland Departments of Commerce and Labor, who remain laser-focused on addressing the financial and operational challenges faced by Maryland businesses,” Maryland Chamber of Commerce President and CEO Christine Ross said in a statement. “We have known since the early days of the pandemic that employers would ultimately confront increases in unemployment taxes. The governor’s announcement today represents a tremendous step in mitigating the impact of increasing costs on Maryland’s businesses. We look forward to continuing to work together on solutions that blunt the economic impact of COVID-19 on our state’s job creators.”

“Governor Hogan’s actions today to protect small businesses from sudden or substantial increases in unemployment taxes and to forgive $75 million in emergency loans are to be applauded as they come at a time when many, especially small and minority businesses, are literally struggling to survive,” Greater Baltimore Committee (GBC) President and CEO Donald Fry said in a statement. “These measures are a first good step to mitigate the economic stress many small businesses are encountering as they struggle to stay operational.”

Hogan did not announce any new restrictions on Thursday. But several jurisdictions in the state already have. They include Baltimore City and Anne Arundel County, both of which recently put forth plans to temporarily halt both indoor and outdoor dining at restaurants.

National Federation of Independent Business (NFIB) state chair Mike O’Halloran said the new restrictions are cause for concern.

“This is extremely difficult news for hundreds of small businesses in these jurisdictions,” O’Halloran said in a statement. “Owners are doing everything they can to protect their employees, customers, and clients. But every time businesses are forced to close temporarily, however, officials think it might be, or face restrictions, which make it impossible to operate, those closures and restrictions mean more businesses will shut down for good, more jobs will be lost forever, and the unemployment numbers will grow.”

O’Halloran elaborated on that point.

“We are at a point of no return for so many small businesses. They have gone to great lengths and great expense to follow every health requirement when it comes to PPE, physical installations, social distancing, and restrictions on customers and operations. Business owners did that to stay open and preserve jobs. But these latest restrictions will likely mean the end for many small businesses especially with financial assistance already exhausted.”

There are 225,855 confirmed cases of COVID-19 in Maryland as of Thursday morning, according to the state’s Department of Health, and 4,850 people in Maryland have died from the virus. The state’s positivity rate is at 7.71%, which is well above CDC recommended guidelines for containment. Maryland has conducted more than 4.8 million COVID-19 tests.

Recent Comments