By Barry Rascovar

For MarylandReporter.com

Another Maryland General Assembly session has come and gone with Gov. Larry Hogan proclaiming victory and legislative leaders breathing a positive sigh of relief.

There were no big wins for Hogan but no shocking defeats, either. His ideologically driven, conservative agenda may sell well with die-hard Hogan backers but it was a non-starter with Democratic lawmakers.

His most solid step forward?

A compromise bill giving manufacturers tax breaks, especially if they provide workers with new job skills (that’s the part Democrats insisted on). It’s not a huge benefit for those companies but it is another incentive that could help persuade manufacturers to move to the Free State.

His biggest defeat?

A set of restrictions imposed on the Hogan-selected state school board, which had its hands tied by Democratic lawmakers to prevent state intrusions into local school board autonomy on figuring out how to turn around failing schools.

Constitutional mandate

Still, the most important issue of every General Assembly session revolves around dollars and cents.

Passing a balanced budget is the only constitutional requirement both the governor and legislature must achieve every year.

This time, they cobbled together a fiscal blueprint that avoids deep spending cuts while expanding state aid and services in targeted areas.

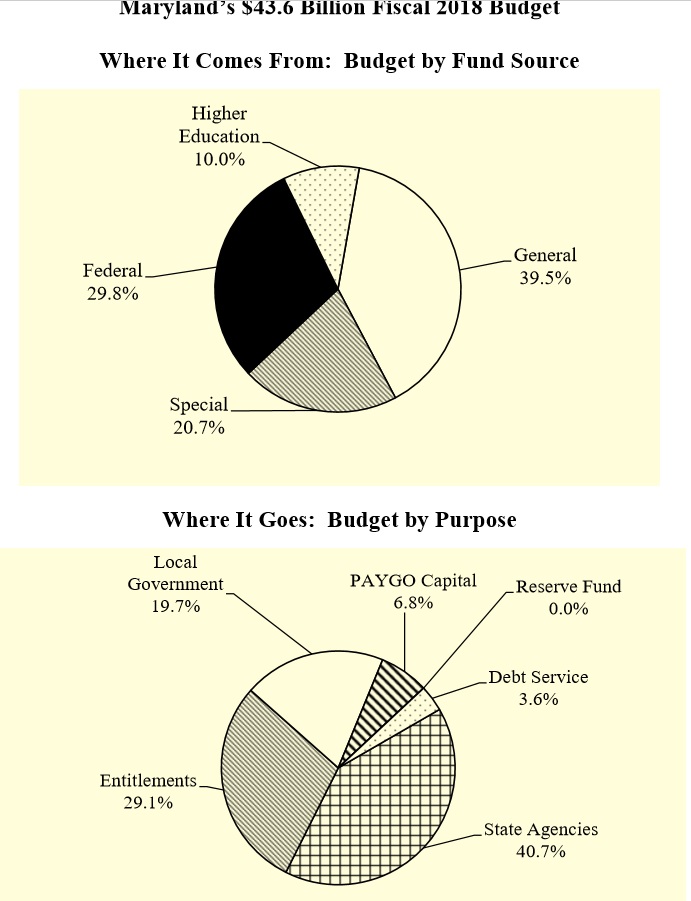

The outcome is a budget for the fiscal year starting July 1 that grows only 1.2%, to $43.6 billion.

The general fund budget essentially remains level. The state workforce holds at 80,000 (no pay raises or longevity increases).

That is a tribute to Hogan’s ability to hold down spending without taking a Trumpian axe to state government and local aid.

That’s the good news.

Source: Department of Legislative Services, 90 Day Review

Dark days ahead?

The bad news: Those ominous storm clouds coming from the nation’s capital – potentially massive federal job losses, large cuts in healthcare, medical research and local aid.

This could give Hogan an Excedrin-sized headache he doesn’t need as he approaches an election year.

There’s an additional problem, too.

The Department of Legislative Services (DLS) predicts that over the next five years, Maryland’s revenue will grow 3.5% annually – versus a 5.4% rise in state spending.

That yawning gap was partially closed in the just-passed budget, eliminating 88 percent of the state’s structural budget gap.

The trouble is that this budget magic was achieved by stripping out money from the state’s Rainy Day reserve fund and moving other dollars around –$202 million worth of “fund transfers.” Another $185 million was saved through budget cuts by the legislature.

Thus, Hogan, Del. Maggie McIntosh and Sen. Rich Madaleno, among others, worked together in the budget process and balanced the state’s books with $91 million to spare.

Deficits ahead

Yet DLS predicts the budget gap will reach $716 million next year, $1 billion in two years and a staggering $1.5 billion by FY 2022.

Why?

“. . . a combination of tepid revenue growth, fueled by a lackluster economy, and growth in mandated spending and entitlements.”

DLS concludes “the Administration will need to take action to address a shortfall in excess of $700 million” next year.

It adds, “The magnitude of the projected shortfalls suggests that discussion will need to focus not only on what services are provided by the State but also the fundamental revenue structure currently in place.”

That’s a polite way of announcing tax increases could be back on the table, whether Hogan likes it or not.

This is especially true if the dire forecasts of historic Trump budget cuts become reality.

Closing a $700 million fiscal gap next year in Annapolis exclusively through spending reductions would be extraordinary – and painful. If Trump multiplies that deficit through massive federal budget cuts and layoffs of Maryland residents, the state could face a financial crisis.

For now, though, the state’s revenue and spending plan for the next fiscal year is in good shape.

But things could change in a hurry between now and year’s end as Trump and the Republican Congress get serious about slashing federal programs, positions and aid to local counties and states.

Barry Rascovar’s blog is politicalmaryland.com. He can be reached at brascovar@hotmail.com

The best way to avoid “shortfalls” and deficits is to start spending less before any loss of Federal money or loss of Federal jobs, facilities, etc. happens…

Also, doing away with “structural deficits” would be a great help…

But, that’s not part of the Democrat “narrative”…

The author is parroting this false Democratic line- that any deviation from perpetual superinflationary growth in state spending is a “cut” to spending. That is simply dishonest. The fact that O’Malley and past legislatures encoded this constant government growth in mandates doesn’t change that fact.

REVENUE IS GROWING AT 3.5%. So with no tax increase, government will already expand by around 2% over inflation. Democrats will get a bigger government, though not as big as they might want.

Citizens voted against yet another series of tax increases after O’Malley’s spending orgy. If the legislature, or the governor, wants to fund different priorities, there is more than enough room in the $40 billion+ the state already spends. Any legislator who doesn’t think they can find at least $1 billion (less than 2.5%) somewhere in this massive $40 billion+ budget should resign. They are not competent to do their job.

Barry, In your article you mentioned that in the next five years DLS is forecasting revenue to be 3.5% annually versus 5.4% rise in state spending. It would seem that the Governor and General Assembly will have to make deal on the spending mandates as well as revenue.enhancements. If it is true more than 3/4 of state budget has spending mandates. The state needs to make deal that if money is not there. They can only get was giving to them last year in hopes of cutting much needed services in this state.

That does include any cuts the federal government is currently considering in its budget. Governor and General Assembly will have to work together to consider all it options to close that budget gap. If that does happen which I do think will because simple fact Congress and state government is up for re-election in 2018, they will not cut their nose off despite their face. However, it will catch up to us eventually and then that is when we feel true pain.