By Len Lazarick

Is a bill targeting online travel companies creating a new tax on services, as opponents claim, or an attempt to close a loophole and collect sales tax on hotel charges the companies are pocketing for themselves?

Those are the key issues the state Senate will be debating Friday as it takes up SB190 that passed out of its Budget and Taxation Committee Wednesday.

Many senators and their staff have admitted struggling with those issues. Sen. Michael Hough, R-Frederick-Carroll, who moved to delay discussion of the bill, said he had heard conflicting views about what the bill does.

The issue is still clear to the bill’s sponsor, Sen. Richard Madaleno, vice chair of the tax committee. “When the statute was written that created a state sales tax, no one envisioned the Internet. This is a tax that consumers are paying, it’s just not coming back to the state of Maryland,” Madaleno, D-Montgomery, said in his initial testimony of the bill last month.

Comptroller Peter Franchot agrees with Madaleno, and is suing the online companies in Maryland Tax Court to collect $6 million in back taxes.

Nobody is arguing that this will not increase costs to the online companies, but at least initially, it doesn’t cost consumers more.

How the transactions work

Here’s how these transactions work.

When you rent a hotel room in Maryland from the hotel, you pay the quoted room rate, plus the state sales tax and often a local hotel tax on top of that.

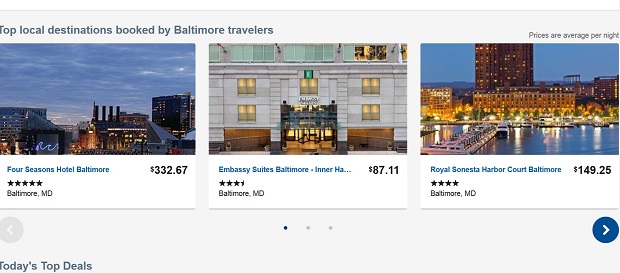

On the Internet, when you book that room at Expedia or Priceline, which together now own almost all the other popular travel sites, the online booker charges the same rate as the hotel, adding taxes and fees. But when the online travel company pays the hotel, it pays a negotiated contractual price that is lower. It pays the hotel that discounted price, and the sales tax based on that lower price, and keeps the difference between the rate it charged the consumer and the portion of the taxes and fees above that.

Madaleno and Franchot want the state to get the tax on that difference between what the person renting the room pays and what the online company reimburses the hotel.

Some counties with a local hotel tax have already reached undisclosed settlements with the companies, which are apparently paying more local taxes.

Passing cost on to the consumer

According to Philip Minardi, director of communications and public affairs for the Travel Technology Association, the increased costs to the online companies will ultimately be passed on to the consumer. These costs would likely be added as part of contract negotiations with the hotels, he said.

Industry data show that a 1% increase in room rates leads to a 2% decrease in bookings, Minardi said. Any extra revenues Maryland raised would be countered by a decrease in economic activity, particularly near the Maryland borders.

The Madaleno bill is being backed by the hotels, with Marriott International of Bethesda taking the strong lead.

The hotels maintain they are collecting the entire state sales tax for the state, and they want the online companies to do the same.

Travel agents could be hurt

Caught in the shuffle as sort of collateral damage are the travel agents still in business in Maryland, about 1,100 people, 80% in firms with five employees or less, according to Eben Peck, senior vice president of the American Society of Travel Agents.

These agents used to get commissions from the hotels for booking rooms, but those commissions have largely gone away. Now the agents charge fees to consumers for booking rooms, and those service fees would become part of the taxable price of the hotel room on which they would pay tax. (The committee amended Madaleno’s bill to remove any tax on commissions.)

“For us to make a living we have to charge a fee,” said Jay Ellenby of Safe Harbors Travel Group in Bel Air, Md.

Old tax or a new tax

Whether this is a new tax or simply an attempt to collect an existing tax that the online companies have been evading is crucial to the debate.

Any new tax would be red-flagged veto-bait for Gov. Larry Hogan who has promised to roll back as many of the “40 consecutive tax increases” of the O’Malley years as he can. (There were actually only about two dozen tax hikes by Change Maryland’s original accounting. The other increases were tolls and fees.)

But aggressively collecting an old tax some companies are evading, as advocated by Hogan’s new ally Franchot, would be a different story.

Yet anything that would put Maryland at a competitive disadvantage, as the online industry claims, or hurt small travel firms, would also run counter to the Hogan pro-business agenda.

A fall-back position for legislators conflicted about what the bill really does is to see if the comptroller’s legal action succeeds later this year, settling the issue of whether it’s an old tax or a new one.

Recent Comments