By Andy Rosen

Andy@MarylandReporter.com

The state has added dozens of women and minority-owned money managers to its pension funds over the past year as part of a legislative effort to make management of the retirement system for state workers more diverse.

So far, officials are happy with the results. Many of the managers had outperformed the larger state fund managers by the end of the fiscal year that ended June 30. And though there were some initial concerns, many believe the new requirements have led the state to successfully focus on smaller managers who have performed well as markets have recovered.

About 4.4 percent of the state retirement and pension system’s $28.5 billion portfolio is now managed by minority managers, according to materials from the Governor’s Office of Minority Affairs. Their count has risen from six in 2008 to 53 at the start of fiscal 2009. The vast majority of those managers are part of the state’s “Terra Maria” (“Mary Land” in Latin) emerging managers program.

The program was expanded and refashioned as a result of legislation that passed the General Assembly unanimously in 2008.

Mansco Perry III, the retirement system’s chief investment officer, said he had initial concerns about the new requirements when he came on board last year. He learned about the new law just days before taking the position, and said the challenge of instituting the new requirements was balancing them with the duty to get a good returns.

“Specifically targeting women and minority-owned firms, to me, is not reasonable investment criteria,” he said. Perry, who is black, said he was able to meet the goals by focusing on managers of smaller portfolios than the pension system had historically looked at, because women and minorities are more heavily represented in that category

“I believe there’s a lot of talent out there, and you just have to be creative about going about it,” Perry said. “I don’t get evaluated based on the number of minority- and women-owned firms that I use. I get evaluated based on my performance.”

Overall, the Terra Maria program was not immune to the struggles faced by most investors in fiscal 2008, when the bottom dropped out of most markets. The fund lost 20 percent last year, while those in the Terra Maria program lost 21 percent.

However, many of the new women- and minority-owned companies were added midway through the fiscal year, and performed better than the program or the fund at large. For the first six months of 2009, the Terra Maria program gained 8 percent, compared with 5 percent growth for the pension plan as a whole.

Out of the 44 minority and women-owned managers added after the start of fiscal 2008 for whom performance data was available, 28 beat the year-to-date performance of the fund at large and 22 beat their comparable indexes.

Some of the managers are counted multiple times because they work for different parts of the fund.

State Treasurer Nancy Kopp, chairman of the pension system’s board of trustees, said the program has worked well and has not weakened the system’s financial performance.

“As the market comes back, I assume that the difference won’t be as dramatic, but particularly in the tough times, the [managers] are smaller, more nimble, and more able to take advantage of changes in the market,” Kopp said.

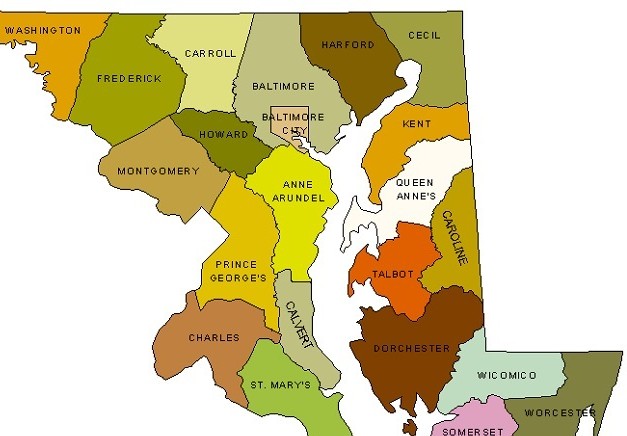

Del. Melony Griffith, D-Prince George’s, the House chair of the joint pension committee, said she’s been encouraged by the initial results from the shift.

It does not appear that there has been much of a difference between big and small funds, at least since the beginning of this year, said Jonathan Rahbar, a fund analyst for Chicago-based Morningstar Inc.

He said smaller managers sometimes have an advantage in economic conditions where smaller companies are growing faster than large ones, because a smaller investor can get a larger impact from smaller investments.

However, small funds don’t generally stay small for long, Rahbar said.

“Generally, if there is a small fund that outperforms considerably, it becomes a larger fund because it gets more attention.”

Susan Stewart, president of Bethesda-based Charter Financial Group, has worked with several pension funds, including ones in Seattle and Illinois, and is one of the firms in the Terra Maria program. She said she couldn’t talk specifically about the Maryland program because she doesn’t discuss individual clients.

However, she said several retirement funds have moved toward using smaller managers, which has helped her firm, with about $150 million under management.

“It allowed us to grow assets and to really develop a good track record,” Stewart said. “Having good clients is a good thing to have.”

Recent Comments