Portions of this article are part of a column that runs in the November issue of The Business Monthly serving Anne Arundel and Howard counties.

By Len Lazarick

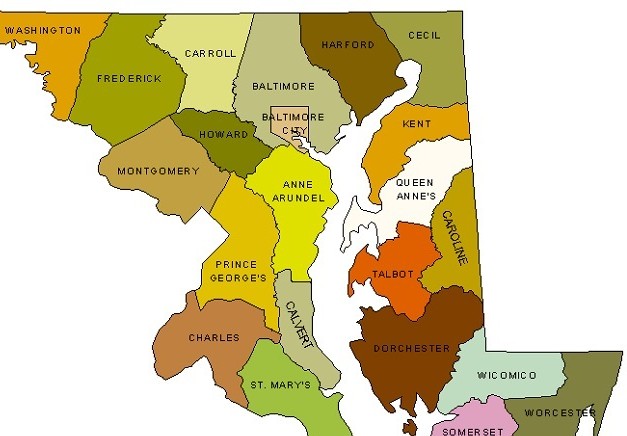

Taxes are a major issue in the three most competitive races for county executive in Maryland: Anne Arundel, Frederick and Howard counties.

In Anne Arundel County, Republican Steve Schuh and Democrat George Johnson focused on taxes and spending. There was a similar even more intense debate in Frederick County, where Republican Blaine Young, current president of the County Commissioners, loudly proclaims he has cut 250 taxes and fees in the race to be the first executive against Democrat Jan Gardner.

In Howard County, with the highest median income in the state, education and social services are the hot topics in the race between Republican Allan Kittleman and Democrat Courtney Watson, with some discussion of the rain tax, and side issues like guns.

Comparing tax burdens

The interesting thing about the focus on taxes and spending in Anne Arundel County races is that almost any way you measure taxes, tax rates and tax burden, Anne Arundel County has among the lowest in Central Maryland.

Yet Schuh is promising a 3% property tax cut, which Johnson says the county can’t afford, though the Democrat is promising not to raise taxes.

Of the nine counties in the middle of the state, Anne Arundel County has the lowest piggyback local income tax rate at 2.56%, lower even than the three solidly Republican counties of Harford (3.06%), Carroll (3.05%) and Frederick (2.96%), the last usually counted as part of western Maryland.

Anne Arundel also has a cap on property tax revenues. This limits any increase in revenues to the rate of inflation or 4.5%, whichever is lower. As higher property values generate more revenue, Anne Arundel’s tax rate is supposed to come down.

The topic of taxes came up constantly in forums involving Schuh and Johnson, because of Schuh’s promise to cut taxes, even though it amounts to only $18 million.

Who’s the bigger taxer

In Howard County, Sen. Allan Kittleman brought up taxes briefly in a debate with County Council member Courtney Watson, slamming her for raising the fire tax (part of the property tax), the rain tax (“stormwater remediation fee”), and the trash “tax” (a fee for trash removal). Kittleman said Howard had one of the “largest tax burdens” in Maryland.

Not so, Watson said. Howard has “one of the lowest tax burdens” and she said she wouldn’t raise the taxes Kittleman cited.

“We live in one of the best places in the country,” Watson, as certified by Money magazine and other publications. “You get the best rate of return” on your tax investment in Howard County, she said, insisting that Howard’s tax burden “is not one of the highest in the state of Maryland.”

In a late October campaign mailer, Watson underlined her support for spending on “top-rated schools and libraries … without raising property or income taxes.”

Watson was relying on a five-year-old study by the Howard County budget office that asked the question: “What is the local tax burden for a typical Howard County resident? How does that tax burden compare to neighboring jurisdictions?”

The study figured the tax burden on a typical Howard County family living in a $414,000 house (the median value) with $99,800 household income (median), and then compared that with what the same family would pay in eight other neighboring counties.

The result: Howard County was seventh at $5,345 in taxes, Montgomery was tops at $6,783, Frederick County was third at $6,358 and Anne Arundel County was dead last at $3,742.

It is very difficult to make such an “apples to apples” comparison, because prices for the same house are higher in many areas of Howard and Montgomery counties, and they differ within counties as well.

According to Kittleman’s campaign, his assertion was based on a total of tax rates and fees.

Different picture from legislative staff

Annual reports by the Department of Legislative Services, the nonpartisan staff of the Maryland General Assembly, paint a different picture of taxes and spending for the three counties. Those numbers show Howard County taxes and spends the most of these jurisdictions, at or near the highest in the state in most categories.

In this year’s DLS report using fiscal 2012 figures (page 40), Howard County has the second highest per capita property taxes in the state, at $1,728. Tops is Worcester County (Ocean City) at $2,354; Montgomery County, which has a low property tax rate but high property values, is sixth at $1,465, Frederick is 12th at $1,185 and Anne Arundel is 14th at $1,095.

Howard also has the second highest per capita local income taxes in the state at $1,219, Montgomery is first at $1,268, and Anne Arundel is 7th at $725, Frederick is 9th at $717, virtually tied $500 lower in these two Republican jurisdictions.

Howard spends the most per capita in the state on education and libraries, $3,262, Frederick is 5th at $2,594 and Anne Arundel is 13th at $2,391. On overall expenditures, which includes state and federal funding, Howard is number 2 in Maryland at $5,694, Baltimore City is highest at $5,925, Frederick is 9th at $4,135 and Anne Arundel is way down at number 12 with $3,976.

Using the legislature’s figures, Howard County residents spend more on their local government and particularly its schools than most other Marylanders. Taxes and spending are in the middle in the four Republican-controlled counties of Anne Arundel, Frederick, Harford and Queen Anne’s.

Taxes and spending are a huge issue in Anne Arundel County and Frederick elections due to the generally conservative political cultures there. But they are much less so in Howard County, despite Republican efforts to make it an issue.

Howard County’s rankings — “best schools” in the state and “best library system” in the nation, best places to live — come at a price that Howard County taxpayers have been willing to pay.

Are property taxes tied to property value? i.e. If you live in a more expensive house you pay more in property taxes? Is that what you mean when you say “per capita” property taxes?