By David Fidlin

Center Square

With short-term solvency and an ongoing pandemic in play, the head of Maryland’s Department of Labor recommended lawmakers not make any tax policy changes to the state’s unemployment insurance system for at least another year.

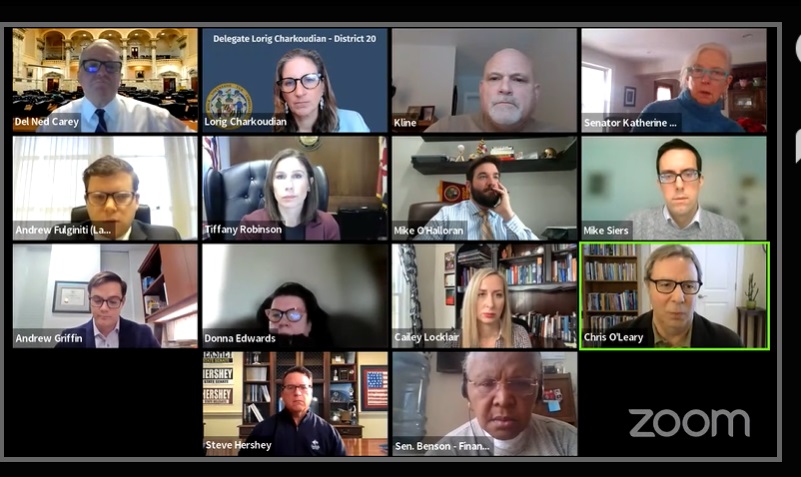

Labor Secretary Tiffany Robinson went before the state Joint Unemployment Insurance Oversight Committee on Jan. 6 and discussed a range of issues about the system, which has been used extensively since the pandemic first emerged nearly two years ago.

With the UI Trust’s solvency projected through at least 2025 under current protocol, Robinson told panelists, “MDL does not endorse or recommend a higher tax burden on the Maryland employer community at this tenuous economic time.”

At the committee meeting, which served as an opportunity for lawmakers to receive updates on the UI system and current claims practices, Robinson also touched on fraud. It remains a concern, she said, though new safeguards have been put in place.

“We had hoped the fraud would be reduced significantly with the end of the federal programs,” Robinson said. “It is reduced, only because the number of claims we are receiving is reduced. However, these fraudsters have decided it’s still worthwhile to find ways to attack our system.”

State Delegate Ned Carey, D-Anne Arundel County, said he and other lawmakers still field concerns from constituents about challenges navigating the state’s UI system.

“We continue to get calls from people who have fallen into the black hole,” Carey said. “What we continue to hear is they just can’t get in touch with somebody.”

Robinson said more than 99% of the claims that have come in since the pandemic’s onset have been processed.

“We are answering every call,” Robinson said. “The only day that we’re having a little bit of trouble is on Mondays, which is our highest weekly certification day, and that makes sense. But we’re getting there. We’re making progress.”

Consultant’s report

The committee also heard a report from consultants at the W.E. Upjohn Institute for Employment Research on next steps in assessing the short- and long-term condition of the UI Trust.

O’Leary touched on several issues of consideration for Maryland lawmakers, including the potential of assessing a tax on individual wage earners – a method used in some states – to help replenish the UI Trust alongside the existing employer contributions.

“(Workers) would get more say in the system, and employers would recognize that workers are shouldering part of the burden directly,” O’Leary said. “There may be more harmony in improving policy going forward. But that’s a political question. I’m just giving you something to ponder.”

The scenario, O’Leary said, could yield $60 million to $70 million in revenue annually for the trust.

While fraud has cropped up, O’Leary said Maryland does have a number of integrity systems in place to weed out people acting unlawfully to game the system. Long term, he recommended additional methods, including face-to-face validation.

State Sen. Katherine Klausmeier, D-Baltimore County, who also co-chairs the committee, said further discussion of the UI system will continue within the committee as 2022 gets underway.

“It’s been a very popular topic over the last, unfortunately, two years,” Klausmeier said. “It’s the gift that just keeps on giving with COVID and all of the other things that have gone along with it.”

TIFFANY ROBINSON IS A JOKE PLEASE STOP MAKING ARTICLES SUPPORTING HER INSOLENCE LETS BE REAL SHE WANTS TO HOLD THE PEOPLE TAX MONEY UNTIL THE LAST DAY SHE LEGALLY CAN ITS AS IF SHE WANTS TO FLAUNT HER EGO BY THIS LITTLE STUNT AND IM SURPRISED THOSE AROUND DIDNT OPPOSE SUCH A LACKLUSTER PROPOSAL

PoliticSay aims to provide accurate, impartial, well-balanced US, International, business, sports, technology, science, politics, Entertainment, health news and analysis. Dedicated to delivering the most premium, non-partisan content regarding domestic and international politics.

Ok don’t know why the number of processed is so high. I get a different answer every time I the one that they been saying now try back next week. And I’ve been hear that for 6 months now