By Daniel Menefee

For Maryland Reporter

Maryland businesses have come out strongly against a proposed change in the annual corporate filing fee that would go from a flat fee structure to a progressive tax based on a company’s assets.

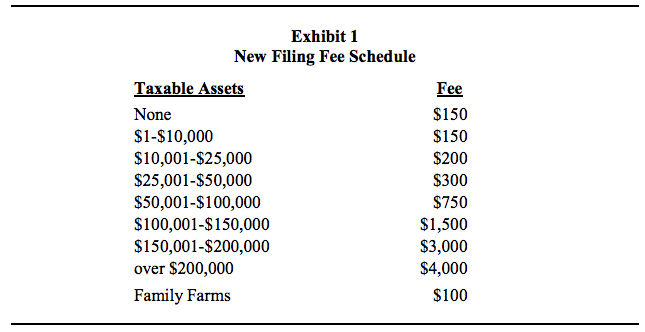

The annual corporate filing fee is currently a flat fee of $300 in order to maintain the legal entity’s existence in the state; the progressive tax could climb as high as $4,000 based on a company’s fixed assets.

Sponsors of the bill say they’ve received massive support from constituents with small businesses.

“This bill is about fairness,” said the bill’s sponsor, Del. Vanessa Atterbeary, D-Howard County. “And it attempts to put businesses on a graduated scale based on their taxable assets.”

Fees would drop for 250,000 firms

Under the measure, HB691, 233,000 entities in Maryland would see the annual fee drop to $150 and another 19,000 would see a decrease to $200. Around 11,000 businesses would continue to pay $300, according to the fiscal note.

In 2003, Gov. Robert L. Ehrlich raised the fee from $100 to $300.

“Essentially what we would like to do is not make Ben Kramer Save the Puppies LLC to have to pay the same amount as Under Armour,” Atterbeary said, using the name of a committee member.

But once fixed assets pass $50,000, the fee more than doubles to $750 and climbs north to $4,000 for companies with fixed assets above $200,000.

“Why should any small business pay the same exact $300 fee…as a Northrop Grumman,” said one of the bill’s cosponsors, Del. Dan Morhaim, D-Baltimore County, in testimony before the House Economic Matters Committee on Wednesday. He said he had received many complaints in recent years about the regressive nature of the tax.

“This does represent a tax break for entities we often say we want to support,” he said.

Del. Chris Adams, R-Dorchester, said the fee under the bill appears to be more of a tax increase than a fee increase.

Del. Chris Adams, R-Dorchester, said the fee under the bill appears to be more of a tax increase than a fee increase.

“We’re getting away from the idea that there’s a fee that we pay for the privilege of doing business in the state of Maryland and moving [it towards a tax], Adams said. He challenged Morhaim’s testimony referring to the fee as a “tax.” Morhaim quickly apologized for the characterization.

Adams said many CPAs in his district complained more about the proposal than the current sick leave bill moving through legislature.

“I got more phone calls on this bill than I did the sick pay bill,” he said. “I got a lot of opposition from the business community on this one.”

Champe McCulloch of Maryland Associated General Contractors said the progressive tax would punish businesses that make investments in Maryland.

“Do you as the General Assembly want to hold business that make substantial capital investments in Maryland in disdain and [assess] a higher fee because they are committed to Maryland and committed to investing in Maryland,” McCulloch asked the committee.

Assets don’t correlate with income

Many who testified against the bill said using fixed assets could raise the fee for companies with higher fixed assets, like trucks and tools, than a small firm with very little fixed assets that makes considerably more from services, like a law firm.

Mike O’Halloran, Maryland director of the National Federation of Independent Business, told the committee that the small businesses the bill aims to help can easily have more than $50,000 in fixed assets.

“You can get up to $50,000 in taxable assets fairly quickly,” O’Halloran said. He said a caterer he knew would see an increase simply because the kitchen equipment easily exceeds $50,000 in value.

Atterbeary said the proposal was revenue neutral.

The initial expenditures to administer the new fee structure comes to $500,000 in fiscal 2018 and $66,000 annually. Revenues are expected to increase by $435,000 annually.

But Maryland Chamber of Commerce in written testimony said the bill was an attempt at a revenue increase.

“The State’s Department of Assessments and Taxation has imposed filing fees to offset the administrative cost to the State of updating corporate documents each year,” the Chamber said. “To replace the traditional fee with a scaled fee is a veiled attempt to increase State revenue at the expense of small businesses.”

Without question this is a tax structure and not a fee, there is no need ( since there is no work by the state once the fee is paid) for there to be much more than a registration fee for having a business in the state.Maryland’s loss will be surrounding states gain.

I’m still baffled why we have to pay one effing dime for the ‘privilege’ of doing business in this hell hole of a state.

It used to be $0. That’s what it should return to.

HB691 strikes me as a resume-builder for its sponsors’ re-election campaigns. I hear very thin and rhetorical justifications; any appeal to equity or fairness is self serving. $500k for state re-tooling its computer systems plus $66k every year thereafter is enough reason to reject the bill, particularly since the between-the-lines language of the Fiscal and Policy Note implies the State has no idea of the secondary effects of raising fees 1334% on businesses with $200k plus $0.01 of assets subject to the personal property tax

Maryland is ranked 41nd in tax policy and has a very high corporate income tax.

https://taxfoundation.org/state/maryland/

Obviously put forth by people who have never run a business and do not understand how business works…. Another sad day for Maryland.