By Dan Menefee

For Maryland Reporter

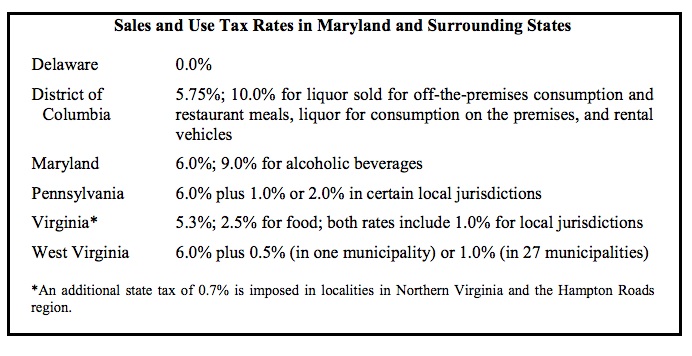

For a second year in a row, Sen. Jim Brochin is trying to repeal the retail sales tax on alcohol that went from 6% to 9% in 2011. He said it unfairly targets one industry and puts Maryland at a disadvantage with neighboring states.

“Currently surrounding states are charging less in sales and use tax…and it’s having a negative effect on local businesses,” Brochin told the Senate Budget and Taxation Committee on Wednesday.

He said alcohol consumption in the state has declined by 10% since the tax went into effect — while sales in other states are up 3.3%.

Brochin, D-Baltimore County, acknowledged the fiscal note on his proposal, SB157, which forecasts a $700 million revenue loss through fiscal 2022, but he believes much of it could be recouped with an increase in consumption.

“I’m not naïve enough to think it would be revenue-neutral but it might end up being close,” Brochin told the committee.

The Department of Legislative Services projects a 3% increase in sales if the tax is repealed.

Brochin said a $14 glass of wine with a $24 entre “seems incredibly out of whack.”

Marty Kutlik, owner of Ridgely Wine & Spirit in Lutherville said the state could maintain the same revenue stream by moving the 2011 increase to an excise tax because it would reflect higher sales. An excise tax is collected at the wholesale level.

“It would become part of my sales,” Kutlik told the committee. “If it’s part of my sales it means I’m more profitable and it means my business has a greater value.”

Kutlik said more than 75% percent of the time his customers use credit cards, and processing the higher tax rate results in more fees charged by the credit card companies.

In opposing the bill, Ann Ciekot, director of the Maryland Chapter of the National Council on Alcoholism and Drug Dependence, said repeal would reduce the revenue stream for “important public health measures.”

“It has definitely helped,” Ceikot said, citing research. “Increasing the alcohol beverage tax reduces certain sexually transmitted diseases [and] decreases binge drinking.”

Ceikot said a report was due out next month that would also show a decrease in drunk driving incidents with the higher tax rate. She said the public health benefits far outweighed the burdens on businesses.

But Brochin rejected the argument that higher taxes results in lower rates of sexually transmitted diseases.

“I’ve never seen any study that shows that is the case,” Brochin said.

He said the tax hike was more a budget measure than a public health issue in 2011.

“That was a deal they made so they could balance the budget and I don’t believe you make a deal on one industry,” he said. “The sales tax in Maryland is 6% so why are we picking on alcohol at 9%. I think it should be comparable with everything else.”

The 2011 tax hike began as an excise tax on liquor wholesalers. When the curtain fell on the 2011 session the excise tax morphed into additional 3% tax on retail sales. The extra revenue was intended to aid those with developmental disabilities, but instead it went mostly for school construction in districts of lawmakers who supported that tax.

Brochin opposed the tax hike from the start and then lamented in the fall of 2011 that the revenue had not been shared with his 42nd district, where elementary schools were at 140% capacity.

Dan Menefee can be reached at [email protected]

I thought that “sin taxes” were a good thing…/sarcasm

And that cutting alcohol consumption was also good and would lead to fewer deaths on the road and otherwise…

Then, there were the beneficial services that were “oh so necessary” and needed funding…/sarcasm

I’ve heard him on the radio talk shows and he’s moronic…

Not mentioned in Dan Menefee’s article on the 9% alcohol tax is that, in the original bill, 15% of the proceeds were to go to public mental health services, 15% to addiction treatment and 15% to developmental disabilities services, among other health-related purposes. Over the 2011 session’s final days, legislative leaders replaced the bill with one that directed almost all of the new revenue to school construction except for a one-time allocation for developmental disabilities. As the link to a 2011 story indicated, money that should have expanded access to critical behavioral health care was used for artificial turf at two Howard County high schools. I worked hard on the original bill as director of the Community Behavioral Health Association of Maryland at the time, and I still resent the ultimate outcome.

Regarding schools… Where did the tax money from the casinos for them go ?

Maryland voters get lied to and yet they keep on electing and re-electing these crooks…

Of course, all of this was reported before today…Right ?

The tax decreased the rate of sexually transmitted diseases? What a load. That statement is just made up and cant be proven. It also leads one to be suspect of anything else she says.

Brochin said a $14 glass of wine with a $24 entre “seems incredibly out of whack.”

1.) If your glass of wine is “$14”, the entree is going to be closer to $40-45. Either that is a really good wine, or the restauranteur is working on an EXTREMELY high mark up. The $14 glass comes from a bottle that cost the restaurant less than $20.

Yet even IF his scheme goes into action, that $14 glass of wine only becomes $13.62

Should the state cut the tax so the vendor can make a near 400 percent markup?

C’mon man… The industry must be funding his campaign…