Goldco Review – Is it the Best Gold IRA Company?

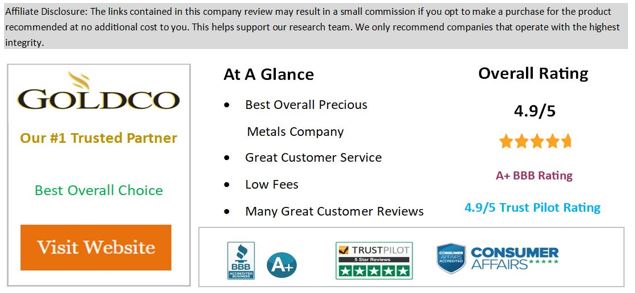

Goldco Precious Metals is a top-rated company that specializes in gold and silver IRA investments. Goldco has an A+ rating with the Better Business Bureau (BBB), and the customer reviews rank 4.8/5 stars on Consumer Affairs, and Trust Pilot. A Goldco IRA rollover can help you protect your wealth as a safe haven for your assets.

As a precious metals brokerage firm, Goldco facilitates the conversion of regular retirement accounts to a Precious Metals IRA. When a customer starts taking distributions from their IRA, they can either purchase the metals back or sell them on the metals market.

Goldco IRA Reviews

Goldco, a major gold and silver broker based in California, was established in 2006 and has won several industry awards since then. An existing 401(k), 403(b), 457, pension, or Thrift Savings Plan (TSP) account can be used to finance a self-directed gold IRA with the use of the company’s transfer services. Roth IRA rollovers and conversions are also available via Goldco, and there seem to be a lot of positive Goldco IRA Reviews from happy clients.

Converting your retirement account to a gold IRA is one way the firm helps you secure your funds. It’s possible to convert some or all of your retirement assets to gold if you’re working with Goldco.

It is the mission of Goldco’s staff to educate clients about precious metals and secure their retirement funds. With the aid of the firm, clients may successfully complete the process of transferring their gold retirement accounts. Additionally, Goldco customers have the option of purchasing gold and silver for personal use.

Goldco Ratings

Goldco has great ratings from a few different rating organizations online.

The Better Business Bureau has given Goldco an A+ grade. Customers give Goldco 4.87 out of 5 stars on the BBB site. The few complaints that were made were all taken care of well and in a timely manner by the company.

The Business Consumer Alliance has given Goldco a “AAA” grade.

Goldco gets 4.8 out of 5 stars from the people who read ConsumerAffairs.

Customers say that Goldco answers questions quickly, and many people have said that the specialists are thorough and patient.

Both Trust Link and Google reviews give Goldco 4.8 out of 5 stars.

Furthermore, this organization has received hundreds of excellent evaluations and endorsements from well-known individuals.

Goldco won the Stevie Award for Company of the Year at the 19th Annual American Business Awards in 2021, gaining national prominence. Since 2011, the firm has been on the Inc. 5000 list of America’s fastest-growing private enterprises.

Goldco Pros and Cons

As a result of its many advantages, Goldco consistently ranks as one of the best IRA gold and precious metal investing firms. However, there are a few minor drawbacks to the firm. Let’s have a look at some of the pros and cons of Goldco.

Pros

- Non-aggressive advisors

- IRA-approved gold and silver coins and bars are widely available.

- Beginners will find this firm easy to use because it is simple.

- Many satisfied customers

- Buyback option with the highest price

- Free first-year fees and a ten percent discount on silver coins are among the incentives for new customers.

Cons

- The minimum amount of money required to get started $25,000, and could be too much for some people.

- Platinum and palladium coins are omitted.

Since 1971, the buying power of the United States Dollar has decreased by 98 percent. On the other hand, gold’s purchasing power has remained stable over time. If you have a gold IRA, you should convert your retirement assets.

Since 1971, the buying power of the United States Dollar has decreased by 98 percent. On the other hand, gold’s purchasing power has remained stable over time. If you have a gold IRA, you should convert your retirement assets.

Who Owns Goldco?

Trevor Gerszt is the owner of Goldco.

Founder and CEO of Goldco, Trevor Gerszt a Los Angeles-based precious metals dealer specializing in wealth and asset protection,

Trevor has been looking for methods to assist individuals to develop long-term wealth through precious metals and other alternative assets for more than 20 years.

High ethical standards and a passion for precious metals guide Trevor in his leadership role at the firm. The power of precious metals has been known to him since he was a child and he has devoted his life to making precious metals more accessible to everyone in order to safeguard one’s life savings.

Goldco Complaints

Even though Goldco has a plethora of positive reviews and ratings, it might be difficult to keep every customer satisfied. Like any big and popular company, Goldco has received a few customer complaints along the way, but it seems that they are always quick to follow up and rectify the situation with any client that had an issue. At the end of the day, that’s all you can ask of a company, is to operate with honesty and integrity.

Goldco has a minimum deposit requirement of $25,000 when many other investing businesses have a minimum of $5,000. Some clients have complained about this disparity, but for many people it does not seem to be an issue.

As a result, many investors choose Goldco when they want to invest their retirement funds in gold. Overall, this organization has a large number of satisfied clients who appreciate the ease with which they may join up and the level of customer support they receive.

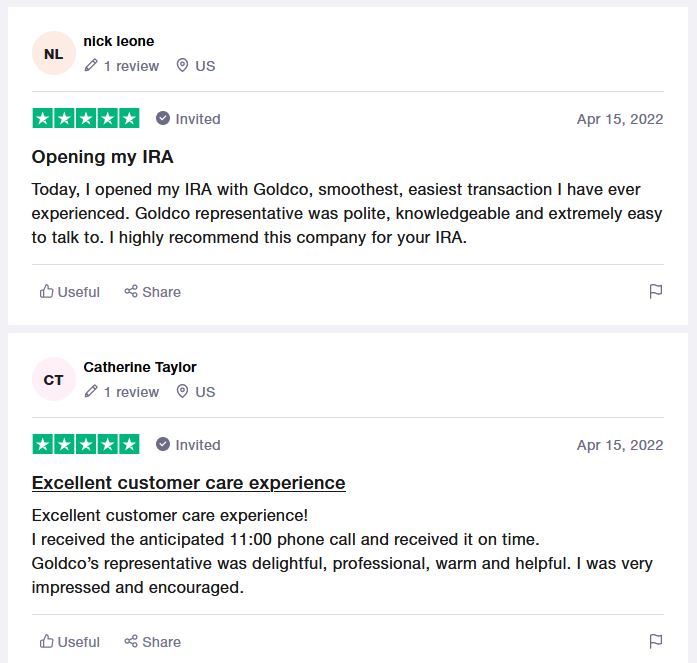

Goldco Precious Metals – Reviews From Customers

Let’s take a look at what customers are saying about the Goldco Precious Metals Company.

Most customers have praised Goldco’s sales and customer service teams, noting that they have helped them a great deal in their business endeavors.

Goldco’s simple 401(k)-to-gold conversion is a big draw for certain customers.

Goldco’s registration process was simple for several customers, who said they had no problems signing up.

Some of the company’s customers appear to be quite pleased with the company’s overall products and services.

Some of the comments above are based on general feedback from clients. Let’s have a look at some reviews from actual customers:

“Prompt and professional, A great experience with no glitches. Ruby does a fantastic job.”

Randy H.

“Capital well-spent”

“Goldco has been a pleasure to work with. Everyone I’ve interacted with has provided amazing service.. If you’re interested in investing in precious metals, I strongly suggest Goldco..”

Sandra D.

“My encounter with you surpassed my expectations in every way.…”

“I was awestruck by Goldco’s professionalism and kindness. It is always a pleasure to deal with them because of their professionalism and friendliness. Buying gold and silver was a simple procedure, and I’m glad I did it..”

Kim

“Excellence in customer service”

The experience of working with Goldco has been nothing short of wonderful.”. Throughout the whole process of acquiring my metal account, everyone I dealt with was kind, knowledgeable, and very professional. Using Goldco, you’ll reach your objective swiftly and easily because the procedure has been optimized. Everyone did a fantastic job, so thank you.!”

Darlene A.

“A particular fondness for competence and in-depth understanding”

“Promptness, honesty, and skill were all highly regarded.. I had all of my questions answered..”

Angela

Protecting Wealth With Goldco

Putting Your Money In precious metals

With the stock and bond markets being so volatile, many investors are looking to diversify their portfolios by investing in precious metals IRAs. Consider a precious metals Individual Retirement Account (IRA) as a way to diversify your investments and as a safe-haven for protecting wealth from the dollar being devalued.

The IRS collectibles rule was relaxed by the Taxpayer Relief Act of 1997, enabling some bullion and coins to be invested in IRAs. It is Goldco’s job to know which coins and bars are suitable for retirement accounts. The rollover procedure has been handled by the customer support staff for decades. You’ll be guided in the selection of IRS-approved custodial and storage services as well as gold and silver.

In order to make it easier for customers to purchase and sell gold and silver, Goldco operates as a precious metals broker. Custodians are required to oversee all IRA funds, and Goldco helps with the paperwork so that the process goes as smoothly as possible. Transferring an existing retirement account into a precious metals IRA is also made simple for clients thanks to the support they receive.

For more than a decade, Goldco has played a key role in helping Americans safeguard their retirement assets. In other words, you may be assured that your money is safe with a Goldco gold IRA. To begin, a Goldco precious metals IRA specialist will take you step by step through the full registration procedure.

After that, your money will be held by a custodian in the same way as any other IRA. These custodians are skilled at safeguarding your precious metals and storing them in secure vaults. In addition, your metals are protected by insurance, making theft or destruction improbable.

With all of these advantages in mind, you can be certain that investing in precious metals with Goldco is risk-free.

After filling out the paperwork, Goldco helps customers pick IRS-approved coins and bullion to put in a precious metals IRA. A specialist works with the custodian and the storage facility to organize the acquisition of assets.

To get started with Goldco, follow these steps:

Step 1. Sign a contract to confirm your purchase. After that, you’ll have to agree to the terms and conditions set forth by the business. The entire registration procedure will be guided by a Goldco employee.

Step 2: Funding a self-directed IRA is a next step once you have one (which permits you to own assets other than bonds and equities, etc.). Make sure you move any assets from retirement accounts such as your 403B or your 401K.

Step 3: You may now buy gold and other precious metals with the money you’ve put into your gold IRA. You may, for example, purchase gold coins and other forms of precious items.

Goldco IRA Fees

If you want to buy from Goldco, you must spend a minimum of $15,000. There is no asset-based cost, only a one-time annual flat price. Goldco does not include fees on its website, although it frequently offers refunds.

The fees for gold storage and custodianship is determined by the business you hire to provide these services (required by the IRS). Storage costs can range from $10 to $60 per month, or 0.35 percent to 1 percent of assets yearly.

Minimum Purchase: Requirement Recommended minimum of $15,000

Annual Cost Communicate with a representative. Possible reimbursement

Storage Costs Vary per Facility.

Fees for Custodians Vary per Custodian. Depending on the account amount, yearly fees range from $75 to $300.

Metals Available Gold and silver bullion and coins authorized by the IRS.

The IRA portion of Goldco’s website has some basic gold and silver charts.

Many variables influence the price of precious metals, including changes in production and mining, volatility in central bank reserves, and interest rates.

How to Set Up a Goldco Precious Metals IRA

Customers can start a precious metals IRA by contacting Goldco directly or by filling out an online application. In order to open an investing account, you’ll need to enter your Social Security number and other personal information.

Goldco will send or email you a detailed handbook on the best ways to invest in precious metals. If you’re still unsure about which gold or silver to buy for your IRA, you may consult with a financial advisor.

Goldco IRS Loophole Guide – Protect Your IRA

The Goldco IRS Loophole Guide is a free educational resource that will show you how you can take control of your retirement, protecting it from financial storms and market crashes with a gold IRA.

Goldco’s main goal is to teach its customers, so that’s what it does. The company also has a Knowledge Center for its clients (available on its website). Customers can look up prices for gold, silver, palladium, platinum, and even eBook videos.

Goldco’s eBooks, for example, include:

How China may annihilate your IRA

The 401(k) and IRA problems in the United States

Buying Guide for Gold and Silver

Ten reasons why the dollar will fall

The Truth About Home Storage IRAs

10 401(k) and IRA blunders you’re making

Additionally, instructive films may be found on the company’s YouTube page, including:

Invest in tangible assets.

Can you rely on megabanks?

Risks to your retirement

America’s massive retirement quandary

The stock market crashes

Goldco Company’s Products

Goldco provides a wide range of gold and silver IRA-approved coins and goods. As with other IRA-approved gold coins, these precious metals have to fulfill the 0.995 eligibility standard (fineness). The corporation works with mints all around the world, including those in Australia, Canada, and the United States, to keep the gold’s purity high.

Listed here are all the items Goldco has to offer.

American Eagle (Type One)

This coin serves as the official U.S. bullion legal tender. Twenty-two-carat gold is used in its production. In 1986, the United States Mint began producing and distributing this gold coin. It’s now available in a variety of sizes, including 0.1oz, 0.25oz, 0.5oz, and a whopping 1oz.

The US Eagle (Type Two)

Likewise, 22-karat gold is used to craft this design. Type one coin has the same design as type two, however, the graphics on type one are different.

American Eagle Proof

One ounce of 22-karat gold was used in the production of these pieces. They come in 0.1oz, 0.25oz, 0.5oz, and 1oz sizes.

Liberty Coin

Goldco is selling a one-of-a-kind coin here. It has an effigy of Queen Elizabeth II on one side and the Liberty Bell of Philadelphia on the other. Featuring a face value of $25, this coin was minted by the New Zealand Mint.

Australian Striped Marlin

The Perth Mint in Australia has produced a 99.9% pure gold coin. In addition, this coin was minted at the Perth Mint as legal money.

Maple Leaf

This gold bullion coin was struck by the Royal Canadian Mint in 1979. One ounce of 99.99% pure gold is included in this coin.

Gold Buffalo

This twenty-four-carat coin was made by the US Mint with 99.99 percent pure gold. The United States Mint’s first 24-karat gold coin is shown on this piece.

American Bald Eagle

The 0.25 oz. gold coin was minted at the Perth Mint using 99.99 percent pure gold. One side of this coin bears the image of a bald eagle, and Queen Elizabeth II is shown on the other.

Military Guinea

East India Company of London produced this special 0.25 oz gold coin to commemorate a specific gold coin.

Freedom Coin

To commemorate the 135th anniversary of the Statue of Liberty’s dedication, the New Zealand Mint produced this one-of-a-kind gold coin.

Freedom of Hope

They used 0.25oz 99.99 percent pure gold to make this coin from the Royal Dutch Mint. This coin celebrates the 245th anniversary of the Declaration of Independence.

Lucky Dragon

This gold coin is a status symbol and a lucky charm. Coins manufactured by the Royal Canadian Mint are made of 99.99 percent pure gold and weigh 0.25oz.

Saltwater Crocodile

The Perth Mint in Australia used 0.25 ounces of 99.99% pure gold to create this coin. Legal tender is also provided for the coin.

British Lunar Series

There are no other gold coins like it since it is based on the Chinese Zodiac, which displays a new animal every year. The Royal Mint used 0.25oz of 99.99 percent pure gold to mint this gold coin at the time of production.

Gold Bars

Aside from gold coins, Goldco also offers a variety of gold bars that meet the purity standard (0.9999). These Goldco bars are IRA-qualified.

Other Products

Goldco offers a wide range of silver and gold items in addition to the aforementioned coins and bars (both IRA eligible and non-IRA eligible). Among them:

Coins and Bars of Silver

The investing firm Goldco owns a large stockpile of silver coins. If you’d like to buy a silver American eagle coin made from 99.99% pure gold, there are two types available: type one and type two. It also carries silver coins from the UK, Canada, Australia, and New Zealand in addition to its own.

IRA-eligible silver bars (with a purity of 0.9999) are also available through the investment business.

Chuck Norris’ Five Principles

Chuck Norris’ Five Principles is a new product from Goldco that’s worth mentioning. The New Zealand Mint produces this one-ounce silver coin, which is not IRA-eligible. The five guiding values of Chuck Norris are shown on the coin’s reverse, including “fight,” “freedom,” “fitness,” and “family.”

Among the company’s many distinguishing features is that it has the greatest possible buyback option for all of its items. If you decide to make a modification to your gold IRA holdings after investing, you can do so at the greatest possible price.

Goldco Q&A

How can I sell gold or silver in my Goldco precious metals IRA?

Those clients who desire to accept payouts from their Goldco accounts are eligible for a repurchase scheme. You may also be able to sell metals with the assistance of your professional.

Is there a storage facility provided by Goldco?

As far as I know, Goldco does not provide IRA storage. However, they have a longstanding connection with a number of IRA custodians. Working with Goldco has the benefit of waiving the first-year storage fees for consumers that sign up. Their 401(k) funds may readily be converted to gold.

Is it possible to keep my precious metals in a safe at my house?

No. The IRS prohibits IRA precious metals from being stored at home or in a regular safety box. Each customer’s precious metals must be stored in a separate location within the storage facility. This guarantees that the metals you bought are returned to you (or cashed in) in accordance with legal distribution rules.

How can I be sure that the value of my IRA’s precious metals is safe?

The future value of precious metals, like any other investment, is not guaranteed and can grow or decline depending on many market factors.

In what time frame may I withdraw money from my Goldco Gold Individual Retirement Accounts?

After reaching the age of 59 1/2, either you or the account’s designated beneficiary can begin drawing penalty-free withdrawals from the account.

How much time does it take to convert a Traditional IRA to a Gold IRA?

IRA rollovers usually take two weeks to execute. Each Goldco application, however, is unique, and processing time varies per instance.

Conclusion

Investors may rely on Goldco to help them make vital decisions about precious metals IRAs, IRS-approved investment options, and more. IRAs in gold, silver, and platinum are offered by Goldco, which has a long history of dealing with the precious metals market. Goldco’s customer service is frequently referred to in online customer evaluations about the process of setting up a precious metals IRA.

In terms of gold IRAs and precious metals, Goldco is one of the best. When it comes to protecting and securing your retirement money, this California-based organization has been there since 2006. Goldco is one of the most reliable sources for purchasing precious metals. To begin, a customer service professional will assist you through the whole registration procedure. Your account can be funded after the process has been finished.

Affiliate Disclosure:

The links contained in this product review may result in a small commission if you opt to purchase the product recommended at no additional cost to you.

Recent Comments