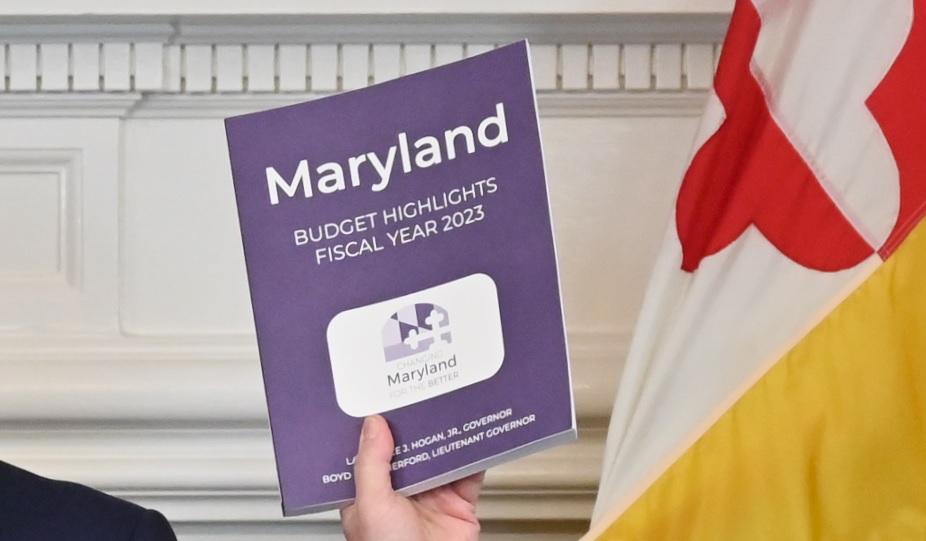

Gov. Larry Hogan proposed a $58.2 billion budget to the Maryland General Assembly Wednesday. With overflowing state coffers, legislators will be pressed by every special interest for a larger slice of the budgetary pie.

The budget process should begin with a careful consideration of “the books.” Before a government spends more money, it’s generally a good idea to consider paying for what has already been bought.

In accounting jargon, the shortfall between what one has and what one needs to have is an “unfunded liability.” The state of Maryland faces two major unfunded liabilities: one in its pension system and one in its retiree healthcare obligations.

As of June 30, 2021, Maryland’s pension system was about 77% funded. Compared to other states, its overall pension health is close to the median. Not terrible, but not great—particularly considering that investment returns have been above average for the past three decades.

The more pressing issue is retiree healthcare, often called “Other Post-Employment Benefits” or “OPEB.” Maryland’s OPEB liability is around $16.4 billion. This obligation is only 2.12% funded. Essentially, the state operates on a “pay-as-you-go” basis.

State officials are aware of this over $16 billion unfunded liability. It made it onto page 51 of the December 2021 Spending Affordability Committee Report. This is the group charged with making fiscal recommendations to the governor and the Legislative Policy Committee. Think of it as the recipe committee for a $58.2 billion dinner.

Overall, the committee made some commendable recommendations including increasing the Rainy Day Fund and repaying money borrowed from the Local Income Tax Reserve Account. The committee also “recommends against making ongoing investments with the cash surplus,” words that warm the heart of any bean counter. One-time money only should be spent on one-time expenses. Regrettably, there was no mention of moving OPEB away from its current “pay-go” status.

The committee’s report and recommendations will go into the fiscal sausage maker that is the legislative session. The Governor has already staked out a position that some of the windfall should be used to grant tax relief. The unprecedented $4.6 billion budget surplus and the anticipated additional revenue in coming years is ringing a dinner bell loud enough to be heard from Oakland to Ocean City.

Because there is no political windfall in addressing unfunded liabilities—and because this is an election year—there likely will be little interest in OPEB. This may come back and haunt the state (and its taxpayers) before the end of the decade.

The U.S. recently posted its highest inflation rate since 1982. Healthcare inflation has lagged, but only temporarily. The seemingly endless COVID pandemic has pushed many healthcare workers out of the profession, exacerbating an existing labor shortage. America isn’t getting younger. Existing healthcare contracts will come up for renewal over time. Economists and people old enough to remember the early 80s understand that inflationary expectations tend to increase inflation.

One of the advantages of a pre-funded trust (like a pension) over “pay-go” funding is the ability to absorb price shocks. The state cannot contain healthcare inflation, but a well-funded OPEB trust could allow time to manage budgetary impacts. Another advantage is investment revenues.

While there isn’t nearly enough money to fully fund an OPEB trust, it would be heartening to see some commitment by the state to move in that direction. After all, if there isn’t enough money in Annapolis now to at least start addressing the issue, when will there ever be?

Recent Comments