By Meg Tully

MarylandReporter.com

Recently released data from the IRS shows that about 5,500 more taxpayers left Maryland in 2012 than moved to the state.

Long-cited by tax critics as annual data that show the migration of taxpayers to lower-taxed states, some experts caution that not too much should be read into year-to-year changes.

“The IRS data presents a snapshot in time for Maryland,” said Daraius Irani, chief economist at the Regional Economic Studies Institute of Towson University. “While many would argue that aha, ‘MD is a high tax state and therefore people are leaving as a result,’ this is a fallacy as it confuses causality with correlation.”

But some argue it shows where dollars are moving and jobs are being maintained and generated – an important factor for policymakers to consider. The IRS migration data is based on the address of record on individual income tax returns filed and received by the IRS from Jan. 1 to Dec. 31 of 2012 (for tax year 2011) and 2013 (tax year 2012).

An analysis of the data for the campaign of Republican Congressional candidate Mark Plaster found Maryland had a net decline of 5,596 taxpayers, with an adjusted gross income totaling $1,633,487,000.

Winners, losers

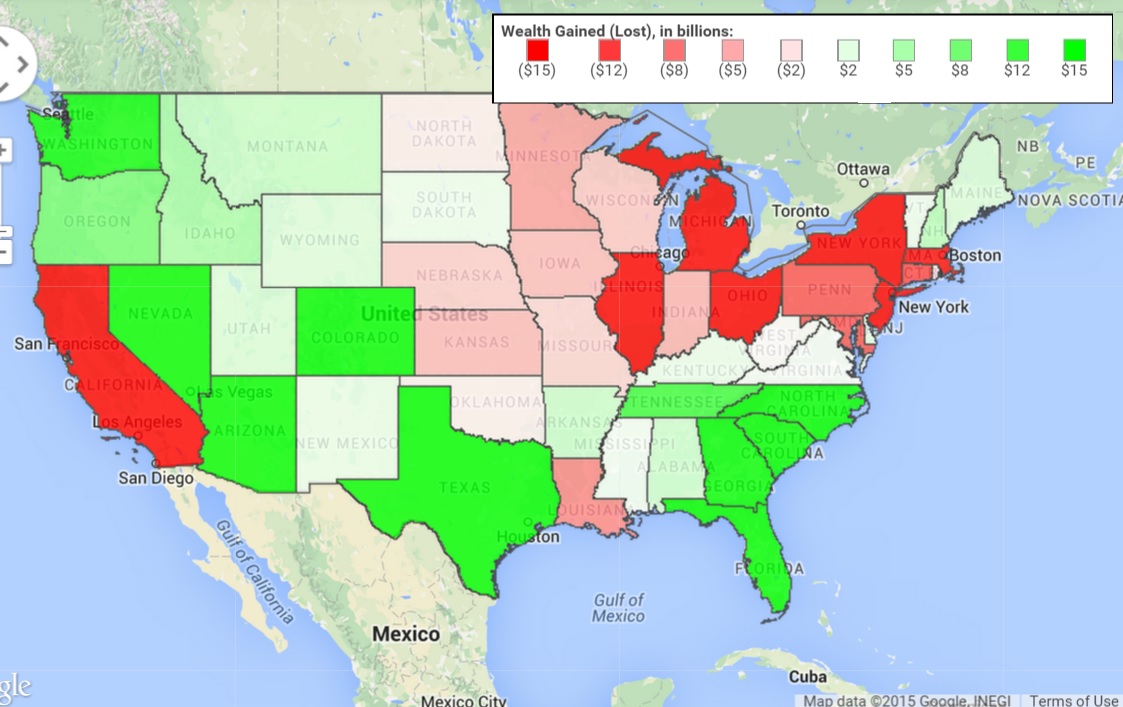

The state ranked 45th for net taxpayer income change and 47th in terms of percentage, with a .9% decline in taxpayer adjusted gross income, trailed only by Illinois, Connecticut and Alaska. Nevada topped the list, with a net gain 1.97% adjusted gross income. In terms of total net adjusted gross income, Florida, Texas and South Carolina saw the biggest gains with $8.3 billion, $6 billion and $1.6 billion respectively.

Within local jurisdictions, Kent and Queen Anne’s counties gained the most in terms of percentage, with Charles County, Baltimore City and Montgomery County losing the most percentage wise.

Plaster was concerned about Baltimore’s numbers, which showed 20,123 taxpayers left and 18,361 went in, for an overall decline of 1,762. That represented an adjusted gross income of $1,165,079,000 going out and $850,171,000 coming in – a net decline of $314,908,000 or about -3.05% of the static tax base. He said solutions need to address why people are leaving one of ‘America’s great cities.’

“Baltimore is a very sick patient and for 50 years Democrats have relied on ever-increasing ‘investments’ as the magical cure for everything that ails Baltimore, and the sad results are in,” Plaster said in a statement. “Government at all levels needs to think through how to create the conditions for economic growth and job creation – it is Baltimore’s best and only hope.”

Motives for moving

Still, the numbers don’t tell the motives of people moving.

Irani said that people could move due to the weather, retirement or new job opportunities, and because of the state’s size and location they may continue to work in the state while moving elsewhere.

The data show that Maryland lost the most residents to Virginia (12,836), the District of Columbia (8,842), and Florida (7,285), and gained from Virginia (12,625), D.C. (9,434), and Pennsylvania (7,258).

“These data by themselves tell us nothing of note and unless someone undertakes sophisticated econometric analysis of the raw data, one can only speculate as to why households may move,” he said.

Benjamin Orr, executive director of the Maryland Center on Economic Policy, said that the information shows some sense of migration, but it should not be mischaracterized.

“Most people can’t take their income with them when they leave the state,” Orr said. He noted that if someone leaves for a new job, the company will likely replace that employee so the income doesn’t leave the state. Or if a doctor retires, other doctors in the area will gain those patients.

“It implies that wealth is generally fleeing the state. In fact what we find is that Maryland has a growing population,” he said. “We still have one of the highest median incomes in the country, we still have the highest concentrations of millionaires on a per capita basis in the country, and we have one of the greatest numbers of ultra-high net worth individuals.”

Overall, the Maryland Department of Planning reports that based on data from the U.S. Bureau of Economic Analysis, annual total personal income rose in Maryland by $7.9 billion between 2011-2012 using constant 2009 dollars, or by $10.9 billion using current dollars, and per capita income rose by 2.8%. That data shows Maryland’s total annual personal income has changed by less than 4% each year since 2004.

But consultant Jim Pettit, who compiled the numbers for the Plaster campaign, said that there are reasons to consider the more specific migration data and pointed to the How Money Walks website that maps the data to see a bigger picture.

Pettit said a Gallup poll that found Maryland had the third-most residents who planned to leave the state in the nation, also cited that 31% nationwide plan to move where the jobs are, not for factors like weather or family.

He also said tax-friendly organizations are “in denial about facts that show low-taxes and a good business climate attract taxpayers.” He noted the top two states with adjusted gross income net growth were Florida and Texas with no state income taxes, and losing were New York and California.

I lived in Maryland several years when my father was stationed there in the military. I still travel to Maryland from time to time. Based on what I see and hear when I am there, I am glad I don’t live there. It’s especially sad to see how Baltimore has decayed. That city is the pits!!

Terp That Fled (and others) It did not say taxation was the reason folks

left at all, as many moved to more pleasant climates. These data by

themselves tell us nothing of note and unless someone

undertakes sophisticated econometric analysis of the raw data, one can

only speculate as to why households may move. People could move due to the weather, retirement or new job

opportunities, and because of the state’s size and location they may

continue to work in the state while moving elsewhere. MD actually gained taxpayers from VA ( a net 12,625), a state most folks hold as a lower-taxation area, like Terp That Fled. A lot more analysis needs to be done.

Irani took issue with the claim that taxation was the reason people fled citing it as the correlation/causation fallacy. My point was that he’s wrong to make that claim definitively as can cite my own experience. It doesn’t mean he cannot be correct broadly speaking, but it does mean he’s wrong to speak definitively.

PS-NOVA’s climate is identical to it’s suburban MD counterpart.

“One of america’s greatest cities” ???

Baltimore? Whoever said this needs to travel more. Baltimore is one of the most corrupt, crime ridden, depressing cities in the country. Unreasonable taxes make it difficult for businesses to operate here and for their employees to live well. If there aren’t high quality jobs attracting and retaining middle income taxpayers, it’s not surprising people are fleeing.

Liberal ideology is so shortsighted and simplistic. Taxes=money. They never think things out to their natural conclusion; taxes are a burden on small businesses, which are the primary source of taxes.

So if there are no taxes, there will be no burden on small businesses. Which are the primary source of taxes? How does that work?

Lower taxes. I didn’t say no taxes.

We should have a census bureau redrawing of the electoral college every presidential election so it’s up to date. It’s obvious Republican states are having population booms and Democrat states are losing population. So the map should be redrawn so we don’t disenfranchise people and so we don’t give states with lower populations using older data from when they had higher populations more electoral influence than they deserve.

Dear Daraius, I’m ome of those 5,600 odd folks. My job did not move from its downtown DC location. I decided I would rather live in Virginia. One of my leading factors was income tax. I earned almost $1,500 more by moving and found the standard the same as where I had lived in Montgomery County. While you cannot attribute the whole to the part, you also cannot say there is no correlation when i’m offering you at least one case of it.

*standard of livinf

And now you get to pay property tax on your vehicles and other major purchases every year. Congratulations on trading one form of tax for another.

And quite frankly, you lived in the most expensive county in the state so…

You’re right, vehicles and boats are taxed. And, it still costs far less in VA.

You’re right, Montgomery is tied for the most expensive county by piggy-back income tax alongside Howard, Baltimore City, Queen Anne’s, Prince George’s, and Wicomico. But the others aren’t far behind with the noted exceptions of Worcester.

VA’s graduated income tax system works as follows:

0-3k 2%

3k-5k 3%

5k-17k 5%

17k+ 5.75%

MD is:

0-1k 2%

1k-2k 3%

2k-3k 4%

3k-100k 4.75%

100k-125k- 5%

125k-150k- 5.25%

150k-250k- 5.5%

250k+-5.75%

Then you add in the piggybacks, which mostly range from 2.7-3.2% more at all levels of income.

MD driver’s license fees range at their cheapest (8 years) are $6 a year, Virginia’s are $4 a year. Car registration is for a new vehicle $40 in VA for most cars, $100 in MD. Titling tax in MD is 6% for vehicles. It’s 4.1% in VA.

Fairfax County’s property tax rate is $1.090. Montgomery County is .9992, but then you have a nice state tax of .112, making the total, 1.1112.

The sales tax in VA is 5.3% except in NOVA (and Hampton Roads), where it’s 6%. In MD, it’s 6%. MD taxes all alcohol at 9%. VA applies the sales tax to it, except on distilled spirits where they do 20%.

Marylanders are always in Virginia buying cigarettes because MD charges $2 per pack versus Virginia’s 30 cents.

Maryland’s gas tax has overtaken VA’s gas taxes.

So, the primary difference is Virginians paying property taxes on cars and boats. Depending on the vehicle age, they’re a couple hundred dollars a year.

So, if you drink copious amounts of distilled spirits, don’t earn any income, don’t drive, and don’t want a driver’s license, then, by all means, enjoy the Old Line State. But don’t come on here and seriously try to proclaim there is a mythical savings by living in Maryland because it’s easily disproven, and to the tune of thousands of dollars for the average Marylander.

Irani’s point about causality and causation is correct, but if he thinks the IRS data at issue are a snapshot, he’s wrong, and his research is stunted by the value of this data in the context of “flow,” a complementary data-set to “snapshot.” I imagine he knows that, it’s just the way his statement sticks out above.

Irani is an executive in the sprawling line of University-based businesses. Universities everywhere have spawned an impenetrable web of large charities and profit making enterprises, without transparency or structured oversight.

His Economic Studies Institute known as RESI performs policy analysis for State government and commercial clients but its finances and business relations are completely hidden from public transparency. I imagine he draws a healthy second income, on top of his $200k plus salary and benefit package paid by state taxpayers. The least I expect from RESI is financial statements, organizational documents supporting legal purpose and scope of operations, and conflict of interest policy, None of that is made public.