By Charlie Hayward

For MarylandReporter.com

Gov. Larry Hogan had high ambitions for his first budget.

Hogan said it was an “attempt to reverse the unsustainable fiscal path we have been following and break the cycle that this state has found itself in year after year.”

To do that the budget increased “general spending by only 0.5 percent while the rate of revenue growth is 3.5 percent – an important step that will begin to bring the budget into a prudent balance.”

These claims are substantially true.

But Maryland’s finances will require many years of budgetary discipline because the state’s balance sheet took a substantial hit due to the recession and its continuing after effects. And in this context, the legislature maintained a nearly rigid spending culture driven by a belief in a cause and effect relationship between marginal spending decisions and their effects on education or social service delivery. Not one dollar could be cut without a commensurate decay associated with educating kids or providing essential social services.

And a close look at the 2016 budget shows the intrinsic budgetary legerdemain needed for budget balance that continues to be hidden deep within the numbers, much of it written into law (such as the requirement for $78 million of 2016 transfer-tax monies diverted to the General Fund).

O’Malley’s overspending erases the rainy day fund

The O’Malley administration and the state legislature oversaw a far more costly government than the state’s revenues could underwrite, as evidenced by an average of $925 million of deficit spending in the general fund’s audited financial statements each year since 2008.

These deficits eroded the favorable equity balance as of June 30, 2008, when the audited financial statements reported almost $3 billion equity, including a Rainy Day Fund totaling $720 million.

Moody’s Investors Service rated the state’s latest bond issue in February 2015. Using the state’s audited financial information, Moody’s reported that overspending since 2008 has brought general fund equity to nearly $1 billion in the red. The cumulative effects of overspending are so substantial, the spending has eliminated the Rainy Day Fund because negative equity exceeds by $152 million the cash set aside in the fund.

Bond rating agencies continue to rate Md. at the highest levels

The good news is each credit-rating agency gave Maryland its highest rating possible in connection with the state’s March 2015 bond sale.

This is no small feat. It puts Maryland is in the top 20% of the 50 states. And among blue-chip corporations just three (ExxonMobil, Microsoft, and Johnson & Johnson) have triple-A ratings. Apple Computer, with $120 billion of cash in the bank and $40 billion of annual revenues merits only a double-A1 rating from Moody’s and AA+ from S&P, a notch below triple-A. Source: Barron’s, November 2014.

The bad news is that ratings cannot go up; they can only go down. And Moody’s, which shows Maryland’s credit rating as “stable,” lists criteria that could lead to potential credit deterioration; ostensibly calling on the state to avoid that condition by:

- Reversing its $916 million negative equity;

- Adhering to plans for fixing underfunded pensions;

- Controlling deficit spending; and

- Halting the continuous draw-downs of reserve funds.

Can Hogan work with the legislature on these challenges?

Audited financial statements show historical spending; budgetary information has limited use

The State’s budgetary calculations show a positive balance of almost $800 million of rainy day money. Budget reporting, however, can be gimmicky. In this case Maryland maintains $800 million cash in the bank, but that cash is committed for “…legislated purposes or to liquidate contracts and purchase orders of the prior period;” and one dollar cannot be spent twice on two objects.

Differences between generally-accepted accounting principles relied on by Moody’s, and budgetary accounting highlight the fact that budgets are “cash-basis” constructs of the governor and the legislature that need not comply with generally accepted accounting principles; aren’t a comprehensive basis of accounting created by any independent standards-setting body; and (lastly) they aren’t audited (although they are closely monitored by the Department of Legislative Services.)

Negative equity of the state is worse than every county’s equity

At the end of fiscal 2014, the state of Maryland is in worse shape than any of Maryland’s 23 counties and the City of Baltimore, according to a January 2015 study by the Department of Legislative Services, Overview of Maryland Local Governments—Financial and Demographic Information (page 111).

Impediments to matching revenues and spending

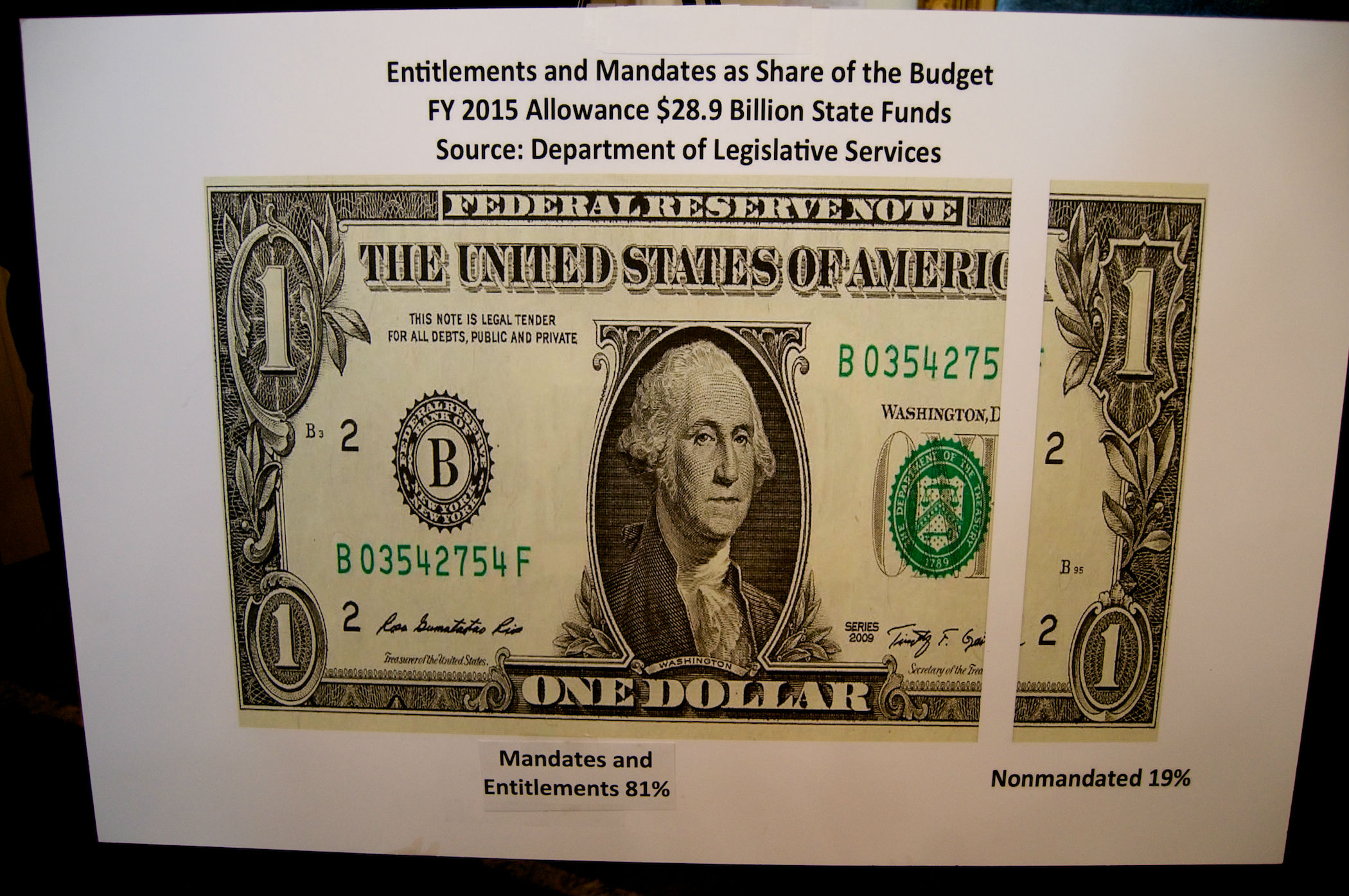

Perhaps the largest impediment to more closely aligning spending with revenues is mandated spending that puts substantially more than half the budget off the table for budget cutting. Education spending must maintain at least the previous year’s per-pupil spending level; at about $15,000/student. Debt service costs are dictated by the terms of the revenue bonds and cannot be altered without defaulting. And so forth.

Creative financing

Legislators use creative financing each year using a “To Do” list to juggle budget numbers and bring them into nominal balance.

This year’s plan required, among other things, increasing state revenues by adjusting estimates for $10 million more revenue for the “Early Medical Loss Ratio Payment,” which is clawback of money from managed care organizations whose administrative costs are higher than mandated by the Affordable Care Act; and diverting Chesapeake Bay 2010 Fund Revenue of $8 million to the general fund.

In addition, the legislature planned to transfer $100 million from the Local Income Tax Reserve Account and $38 million from Transfer Taxes; $11 million from Program Open Space monies; $8 million from the State Unemployment Compensation Fund; and $6 million from the Strategic Energy Investment Fund.

The final numbers were modified in the budget reconciliation bill to be signed by Hogan. However, the law Hogan will sign partially continues the legislature’s creative budgeting signed off by O’Malley over the past eight years.

Perhaps “mandated spending” should be eliminated… Or adjusted to reflect the reality of reduced revenues….

$15,000 per student ? Why not give vouchers to every patent of school age children to attend the school’s of their choice ? It would cost less than what is being spent…

The article also asks if Governor Hogan can work with the legislature to solve the problems the state faces…

The real question is: Will the Legislature ( Liberal/ Progressive Democrats ) work with

Governor Hogan ?