Tag: State Retirement Agency

Critics slam pension fund performance, system slam...

By Len Lazarick | September 25, 2014 | News | 7 |

Maryland pension fund misses investment target again, earning just over 1%

by Len Lazarick | August 13, 2016 | News | 3 |

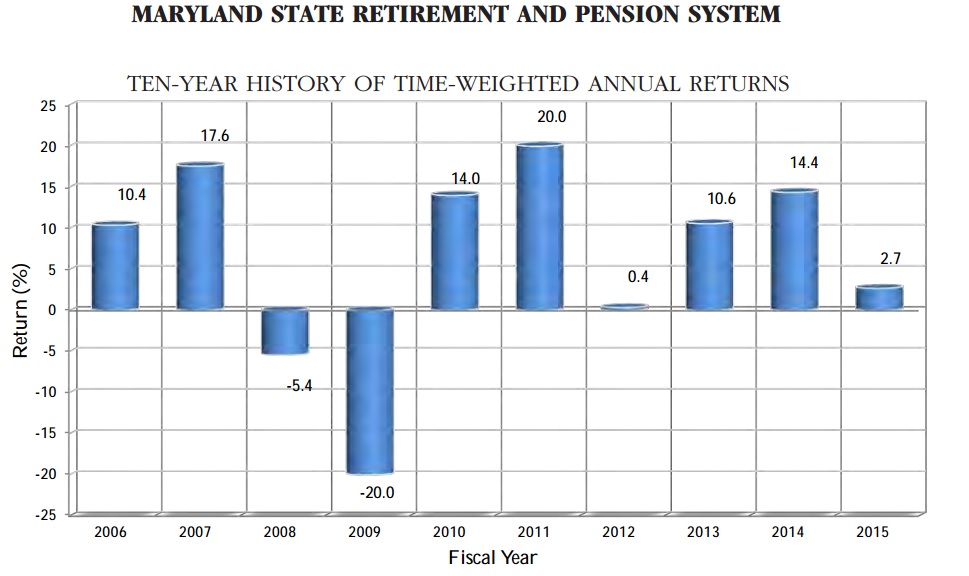

For the second year in a row, Maryland’s pension fund missed its target for return on its investment portfolio by a wide mark, earning just 1.16% for the fiscal year that ended June 30 compared to its annual goal of 7.55%. Last year, the fund made 2.68%.

Because of the lagging returns the $45.5 billion fund is apparently worth $300 million less than it was worth June 30 last year, and long-term liabilities are over $20 billion.

Critics slam pension fund performance, system slams critics

by Len Lazarick | September 25, 2014 | News | 7 |

Persistent critics of the investment performance of Maryland’s $45 billion pension fund for state teachers and employees are again slamming the fund for failing to match the performance of other state pension systems, even though its 14.4% return was nearly twice as high as the fund’s target.

Read More$50 billion in unfunded state and local retirement benefits, study says

by Len Lazarick | October 30, 2013 | News | 7 |

The money Maryland’s state and local governments have failed to set aside to fulfill pension promises made to teachers and employees has ballooned to more than $22.5 billion over the past five years, a new report has found.

But the counties that run their own pension systems are in much better shape than the state of Maryland, with the exception of Prince George’s County.

The most under-funded retirement benefits continue to be health insurance for these retirees, which amount to $28 billion for state and local governments. Only a handful of county governments have tried to sock money away.

Read MorePension system advisor ‘very disappointed’ in legislative cut in contribution

by Len Lazarick | April 17, 2013 | News | 3 |

The outside advisor for the Maryland pension system told its Board of Trustees Tuesday that he was “very disappointed” that the legislature reduced the state’s payment into the retirement fund by $100 million in budget action this month. The money comes from $300 million in added contributions of state employees and teachers passed in 2011. It is being set aside for the possible federal budget cuts from sequestration.

Read MoreLegislator wants to reduce risky investments in pension fund

by Len Lazarick | March 13, 2013 | News | 1 |

A legislator who has spent his career as a financial advisor and investor is seeking to force the state pension system to limit what he sees as risky investments in private equity, hedge funds and other alternative assets.

The investment managers at the State Retirement Agency told the House Appropriations Committee Tuesday that Del. Steve Schuh’s legislation, HB819, will mean lower returns on investment and less diversification for the $38 billion fund that pays for pensions for teachers and state employees.

Read MoreState pension system pays too much to advisors, think tanks assert; retirement officials disagree

by Len Lazarick | January 23, 2013 | News | 4 |

Two of Maryland’s free-market think tanks are again attacking the Maryland pension system for spending too much money on investment advisors who are not producing enough returns. But the State Retirement Agency says the advisors have helped it reach its benchmark investment goals.

Read MoreState pension gap grows to $17.5 billion

Maryland will likely have to increase payments to its teacher and employee pension funds by $189 million next year, lawmakers learned Tuesday as officials with the State Retirement Agency broke down its results from fiscal 2009.

Pension officials said the state’s pension funds have promised to pay out $17.5 billion more than Maryland has put aside. The State Retirement and Pension System of has about $28.6 billion.

Read More

Support Our Work!

We depend on your support. A generous gift in any amount helps us continue to bring you this service.

Recent Comments