Tag: income taxes

Franchot urges Marylanders filing paper tax return...

By Maryland Reporter | April 9, 2020 | COVID-19, News | 0 |

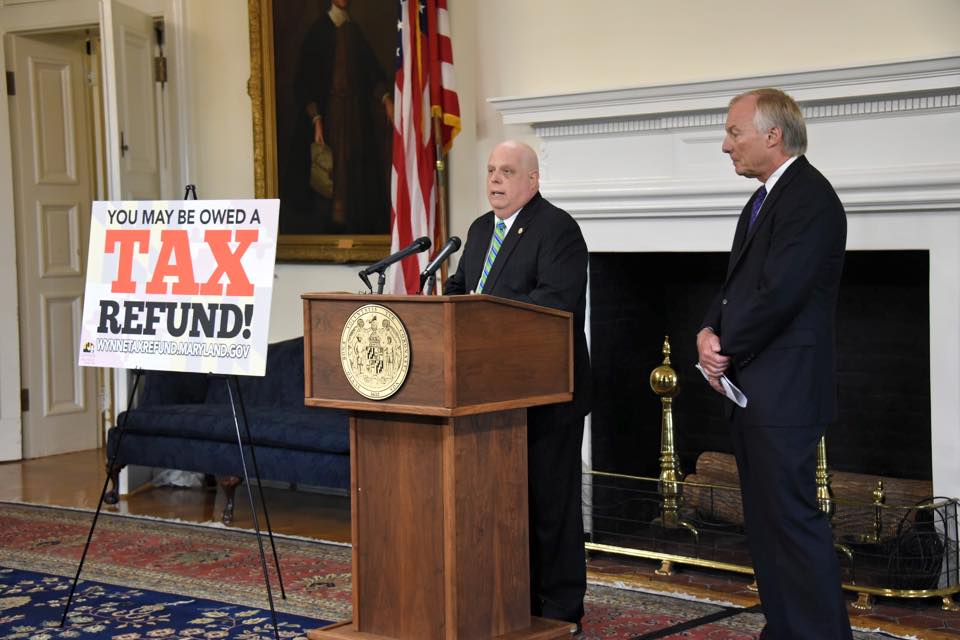

Hogan, Franchot tout $200M tax refund, but judges ...

By Len Lazarick | September 28, 2015 | News | 1 |

Franchot addresses Maryland’s taxpayers’ concerns ahead of filing deadline

by Bryan Renbaum | July 13, 2020 | COVID-19, News | 0 |

Comptroller Peter Franchot sought to alleviate Maryland’s taxpayers’ concerns ahead of the next filing deadline, saying his office will treat them with respect and be responsive to their questions.

Read MoreFranchot urges Marylanders filing paper tax returns to do so by Friday

by Maryland Reporter | April 9, 2020 | COVID-19, News | 0 |

The deadlines for the sales and use tax as well as March quarterly payments are both extended to July 1.

Read MoreHogan, Franchot tout $200M tax refund, but judges and Howard County couple deserve credit

by Len Lazarick | September 28, 2015 | News | 1 |

Republican Gov. Larry Hogan and Democratic Comptroller Peter Franchot were at the podium in the State House Monday taking credit for a $200 million income tax refund that 55,000 Marylanders could apply for.

But it was actually judges on the U.S. Supreme Court and Maryland’s Court of Appeals that should have been standing there, or even better Brian and Karen Wynne of Howard County who deserved the credit.

Read MoreAudit finds state tax information not always verified, refund checks not controlled, sensitive taxpayer information not protected

by Len Lazarick | September 10, 2013 | News, Taxes | 2 |

The agency that collects most Maryland taxes had lax controls over granting tax credits and refund checks, and in one case issued a $101,000 refund that wasn’t due, state auditors found. The comptroller’s Revenue Administration Division also had computer programming errors and did not adequately protect sensitive taxpayer information, according to an audit report.

Read MoreMaryland a net loser as taxpayers migrate

by Len Lazarick | August 21, 2013 | News, Taxes | 88 |

The Tax Foundation published a new map Monday showing the migration of income between states in the decade 2000-2010, with Maryland losing $5.5 billion in taxable income along with 66,000 residents.

Read MoreNew poll: Too little spending on schools, not enough taxes from high earners

by Len Lazarick | November 1, 2012 | Education, News, Taxes | 7 |

Almost two-thirds of Maryland residents (65%) feel Maryland spends “too little” on public schools despite a rising trend in state and local government education spending, a new Goucher College poll found.

The poll also found that 60% of Maryland residents feel that high-income earners don’t pay enough taxes, despite a state income tax increase in May that forces over 300,000 Marylanders earning six figures to pay a higher tax rate.

Read MoreProgressive delegates objected to the income tax hikes too

by Len Lazarick | May 18, 2012 | Governor, News, Taxes | 10 |

As Republican delegates railed against the proposed state income tax hike Wednesday afternoon, a lone freshman Democrat from one of the most liberal and affluent districts inside the Capital Beltway got up to explain why she too could not vote for the taxes.

“I believe this discriminates against two-income families with children at home,” said Del. Ariana Kelly, a Bethesda mom with two young children at home.

Read MoreSenate passes budget, tax hikes; video captures demonstrators for and against

by Len Lazarick | May 15, 2012 | Governor, News, Taxes | 0 |

The Maryland Senate passed a final budget and over $300 million in tax hikes shortly after noon Wednesday. The House starts debate on the bill Tuesday afternoon. A video shot throughout the day on Monday shows the demonstrators opposed to the tax hikes and spending increases, and a rally by public employee unions supporting the bills.

Read MoreSpeaker Busch: ‘Only 16% of Marylanders are being asked to pay a little more’

In this podcast, House Speaker Michael Busch spoke to reporters about the budget and the cuts that would have to be made if tax increases don’t pass. “Only 16% of Marylanders are being asked to pay a little more.”

Read MoreGov. O’Malley touts low taxes as he calls special session to raise them

by Len Lazarick | May 10, 2012 | Governor, News, Taxes | 9 |

Maryland has some of the lowest taxes in the country, Gov. Martin O’Malley said Wednesday officially announcing plans to call a special session of the legislature to fix a budget impasse — partially by raising taxes.

Read More

Support Our Work!

We depend on your support. A generous gift in any amount helps us continue to bring you this service.

Recent Comments