By Alex Mann

Capital News Service

New federal tax laws will benefit most Marylanders in the short term and especially help those with children, but are likely to reduce charitable contributions, a comprehensive analysis released Thursday by the state comptroller predicted.

As state law stands, Maryland’s tax deductions are based on those at the federal level.

Without changes in state law, Maryland taxpayers will pay upward of $572 million more in state and local taxes in the 2019 fiscal year, while their combined federal tax burden would decrease by $2.8 billion, state officials said.

Republican Gov. Larry Hogan released a plan Thursday to mitigate the negative effects to Marylanders. Democratic leaders in both chambers of Maryland’s General Assembly have said they will follow suit.

The new federal law “is going to impact every single taxpayer and everyone’s situation is going to be different,” said Andrew Schaufele, director of the state’s Bureau of Revenue Estimates, which prepared the impact report.

The increase is largely attributed to a “new $10,000 limitation on state and local tax for federal itemized deductions,” which will prompt the majority of taxpayers to opt for a new, larger standard deduction, according to the comptroller’s report.

Under current law, Marylanders who choose a standard deduction on their federal income taxes are required to do so for their state income taxes. However, Maryland’s standard deduction is much smaller than the new federal one.

Winners and losers

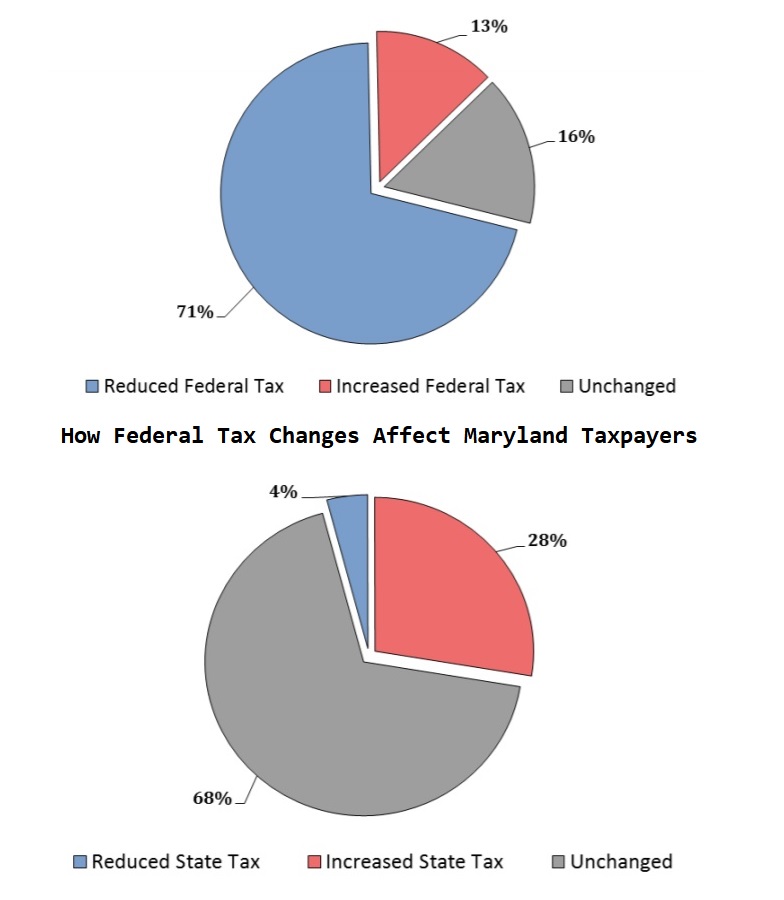

The report estimates an approximate $2.8 billion federal tax cut for Marylanders this year, meaning 71 percent of the state’s taxpayers will pay less in federal taxes, 13 percent will pay more and 16 percent will pay the same, according to the comptroller.

About 2 million Marylanders are expected to benefit, with an average gain of $1,741 per taxpayer.

Much of the federal tax reduction can be traced to four provisions in the Tax Cuts and Jobs Act: The child tax credit has been doubled; federal tax brackets and rates were adjusted; the standard deduction was changed; and a new deduction was created for qualified business income.

“The child tax credit is a big deal,” Schaufele said. “It becomes quite hard to find a typical taxpayer that will lose at the federal level.”

Individual taxpayers would be affected differently depending on whether they choose to “minimize their combined federal-state-local tax burden or focus on their federal tax,” according to Comptroller Peter Franchot, a Democrat.

If taxpayers prioritize overall savings, the release explains, the amount of state and local tax owed would not change for almost 70 percent of Marylanders. Twenty-eight percent of Marylanders would pay more and 4 percent would pay less.

Charitable donations will take blow, as the federal tax bill effectively eliminates the tax benefit of charitable contributions, according to Franchot.

“We’d hope that everyone would continue their level of altruism, but it’s just not going to be there at the current level,” Schaufele said.

Hogan announces counter-measures

Hogan later on Thursday announced a measure to counter the effects of the federal tax overhaul on Maryland taxpayers by severing federal taxes from state and local duties.

The governor’s Protecting Maryland Taxpayers Act would make permanent a provision in Maryland law that prevents changes in the federal tax code from affecting state and local taxes. It would also allow Marylanders to take standard deductions at the federal level while still being able to itemize state deductions.

“This new federal legislation creates a situation where Maryland taxpayers wanting to benefit from the federal tax cuts could only do so if they choose to forgo many long-standing Maryland deductions,” Hogan said.

“Marylanders should not be forced to make that choice — our taxpayers deserve the best possible tax treatment,” at both levels.

Democrats are expected to announce their tax mitigation plans this week.

Del, Jimmy Tarlau, D-Prince George’s, who serves on the House Ways and Means Committee, told the University of Maryland’s Capital News Service that his panel is addressing three key areas to offset federal tax changes: personal exemptions, the estate tax, and the ability to itemize.

My legislation affecting wealthy Marylanders uncouples the state from federal estate-tax rules,” Tarlau said in a statement. “Maryland, which currently taxes inheritances greater than $4 million, would lose as much as $60 million a year if it uses the new federal threshold. Most Marylanders believe that if you are left over $11 million in an estate paying some taxes on it is not a real hardship.

“I have tried unsuccessfully to uncouple Maryland from federal estate-tax rules in previous sessions, but this year the Democratic leadership is backing the idea.”

Republican leaders back Hogan’s approach

“The information that came from the Comptroller’s Office this morning confirmed what we already knew to be true,” said House Minority Whip Kathy Szeliga in a statement. “The Republican-led effort to cut taxes on the federal level will allow Marylanders to keep significantly more of their hard-earned money. Marylanders will be paying $2.8 billion dollars less in federal taxes as a direct result of the Tax Cuts and Jobs Act.”

“Democrats have made Maryland one of the highest-taxed states in the country,” said House Minority Leader Nic Kipke. “Our hardworking taxpayers do not need another tax hike. I urge Democratic leaders to support the Governor’s simple, fair, and honest approach that will hold the line on taxes and allow Marylanders to fully benefit from the federal tax cuts without being penalized on their state taxes.”

Unless the legislature – governor modify the upcoming tax-season’s rules such that the entire $572 million MD tax increase cited in the story is zeroed out, they will have acquiesced to higher MD taxes while simultaneously claiming they’ve drastically cut taxes. They should be expected to do so based on prior experience. Hopefully the scope of DLS’ analysis of tax legislation will provide a number for comparison against BRE’s $572M.