By Roy T. Meyers

For MarylandReporter.ocm

Gov. Larry Hogan wants the General Assembly to reduce how mandated spending puts pressure on the state’s budget. His goal is a good one–only 17% of the state’s own-source spending in fiscal 2016 is flexible absent legislation. But if he wants to realize this goal, he needs to adopt an approach that matches his periodic rhetoric of bipartisanship.

Why is so much of the budget ‘mandated?’

“Mandates” come in three forms. “Entitlements” provide individuals with the legal right to benefits (e.g, Medicaid coverage).

“Mandates for purpose” dedicate funding streams to restricted purposes (e.g., health spa fees help fund consumer protection activities); as a group they are treated as “special funds,” which are separate from the general fund and thus often excluded from popular descriptions of what is inaccurately called “the budget.” “Mandated amounts” require the governor to include specific appropriations in the budget (e.g., for community colleges).

The General Assembly uses mandates and entitlements for a variety of reasons: to comply with a constitutional requirement to fund elementary and secondary education, to protect vulnerable populations, and to declare that some spending is high priority for more than one year.

A 1916 constitutional amendment encourages mandates

To fully understand mandates, one must go back in history by a century. In 1916, following a state budget crisis, the state adopted a constitutional amendment that was an extreme version of the “executive budget” reform then in vogue. It granted extraordinary budget powers to the governor by preventing the legislature from adding funds to the proposed governor’s operating budget.

Requiring the governor to develop a comprehensive budget request was a valuable reform. But the authors of the 1916 amendment erred in assuming that only the governor could be entrusted with the state’s finances. William Allen, an expert proponent of executive budgeting, but an opponent of the extreme 1916 amendment, wrote in 1917 that: “Nothing could be more unscientific and absurd than to ask legislators to deal intelligently or honestly with executive proposals if the constitution prohibits them from considering at the same time evidence existing anywhere in the state that the governor’s proposals are inadequate.”

Legislature can improve budget, but also create inflexibility

Because it is self-evident to citizens and legislators that Maryland’s legislature should not be a rubber stamp, the General Assembly has adapted. Its justified response has been to mandate spending in future budgets, a power that was confirmed by a 1978 constitutional amendment.

Mandates can prevent a governor from single-handedly starving a deserving program of necessary funds. They are more effective than pleading for insertion of additional spending in a supplemental budget or next year’s proposed budget.

One drawback of this approach is that sometimes mandates have been added without knowing how additional spending will be financed. In other words, giving the governor so much power in the name of fiscal responsibility ironically created incentives to generate a structural deficit in the general fund.

Governors from both parties have at times endorsed mandates even when they have had this effect. To change those mandates, current laws are typically amended through a complicated “Budget Reconciliation and Financing Act,” rather than by simply changing amounts in the regular budget bill.

Increasing budget flexibility

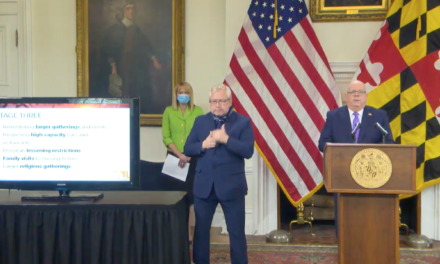

Gov. Hogan recently held a press conference to support passage of his bill on mandate relief. Unfortunately he made some hyperbolic and unjustified claims about excessive legislative spending, in an apparent effort to convince the public that the legislature can’t be trusted. Since the bill would limit what little ability the legislature has to influence spending, this approach seems designed to create a legislative impasse.

This is discouraging, because in fact there is a potential bipartisan deal that could increase the ability of both branches to be responsive to Maryland’s citizens, while keeping the state in a stable financial position.

The first part of the deal would be to send to the public a proposed constitutional amendment that would allow the legislature to add amounts to those requested by the governor as long as total spending does not exceed the governor’s request.

Unfortunately, governors have traditionally opposed this bill. They say it is a “power grab” by the legislature, and they claim that it would promote fiscal irresponsibility. But under the bill, if the legislature increases spending items, those must be offset by savings elsewhere to fit under the governor’s requested budget total. In addition, the Governor would have a limited line item veto, subject to override. This is hardly a radical weakening of gubernatorial power or a license to waste money.

Sometimes opponents of this bill also make a “Chicken Little”-type claim that it would endanger Maryland’s AAA bond rating. Yet in 2004, the bond rating agencies ruled that amending the constitution this way would not risk our top rating.

Achieving checks and balances

Part of the governor’s mandate relief bill would prevent the legislature from adding a required appropriation unless that amount was offset by savings from existing required appropriations. This offset requirement is a reasonable constraint if paired with the constitutional amendment just described.

The rest of the bill would grant the governor power to not include in the budget mandated amounts. This would effectively give only one branch of government the right to dictate spending, which–again–is an unwise rejection of the checks and balances principle that is central to American government.

There are better ways of increasing the budget’s flexibility. One would be to reduce the number of special funds. Another would be to adopt a sunset procedure that would schedule on a rotating basis the examination of all mandated amounts, entitlements, and tax preferences.

The General Assembly could also follow the governor’s lead in building up the balances in the rainy day fund to a much higher level than currently targeted. This counter-cyclical saving would help avoid destructive cuts when the next recession occurs.

Roy Meyers is professor of political science at the University of Maryland Baltimore County and affiliate professor of public policy. His research is concentrated on government budgeting.

The Legislature should also treat the Governor as “an equal”…

Not being an expert in this area – how many of these special funds (excluding mandated “entitlements”) are reviewed for usefulness, efficiency or just their very existence? As a resident of Montgomery County, the word “sunset” is defined by our legislators as a continuous sunrise – our energy tax being a prime example. Would all of this be moot when both the legislature and the governor are of the same party?

Every legislative session the republican state senators and state delegates consistently vote against the passage of every state budget.

SB 808 is all take and no give and, as such, would (if approved on November’s ballot) grant the legislature greater power without ceding anything to the executive branch. I can’t agree with Myers’ recommendation to pair a certain portion of Hogan’s HB 449 mandate relief with SB 808, unless such pairing is created within the text of the constitutional amendment to be put on the ballot. Myers was not clear on this point but I gather he’s OK with a deal to change the constitution to enhance legislative power and pass a law to enhance executive. Seems lopsided.

I agree with his “sunset procedure” idea. On the other hand, I can’t agree with his “reduce the number of special funds” idea. He gives no rationale. These special funds are established to match budgetary revenues and expenses, and I see no justification for obliterating the audit trails.

The legislative approach offered in SB 808, while well intended, would probably create more problems that it would solve. In all likelihood, by transferring to the legislature new powers to increase and (necessarily) decrease budget items, special sessions – at least when a Republican Governor is in office – would surely be an annual exercise. Further, these special sessions would become hyper-politicized if (likely, when) the programmatic spending priorities of the legislature collide with those of the Governor. To make up for, say, increased spending on education, the legislature would look for cuts that harm the Governor’s priorities, and so on. And all this give and take would have to be resolved in the pressure cooker of a special session. Overall, this bill is probably not a good idea.

That’s quite an analysis given that you have two partisan hacks running the House and Senate. It makes no difference what Governor Hogan does. Unless he simply rubber stamps whatever the Mikes want he is perceived by liberal commentators as “not treating the legislature as equal partners”. Spare me, please. Governor Hogan is doing exactly what he was elected to do: Bring some fiscal responsibility to a state that hasn’t had any in many years.