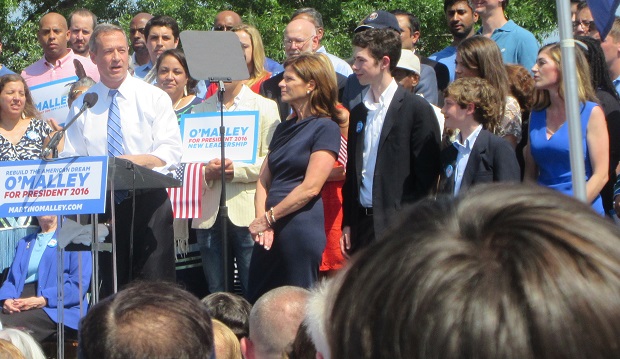

Photo above: Martin O’Malley announces his candidacy with family on stage.

By Barry Rascovar

For MarylandReporter.com

Should we elect as president a candidate who can’t seem to handle his own family’s finances?

Martin O’Malley, presidential contender and former Maryland governor, ran up $339,000 in college education debt for just two of his four children – a staggering amount – on an annual family income that easily topped $300,000.

The O’Malleys lived for eight years in a rent-free mansion where all meals and other household expenses were picked up by the state. They had no mortgage payments to make. They were driven everywhere in state-owned cars by State Troopers. They didn’t have to pay for gas, insurance or car repairs.

Given their minimal living expenses, why couldn’t the former governor and Judge Katie O’Malley contribute more of their hard-earned paychecks (and Martin’s pension as Baltimore mayor) to pay down their daughters’ college loans?

With two more children approaching college age, it’s possible the O’Malleys’ college debt soon could exceed $500,000 or $600,000.

That doesn’t say much about Martin O’Malley’s ability to balance his family’s bank statements without going heavily into debt – even on a two-income figure that most couples only dream about.

Trust him with federal debt?

Would you trust a debtor presidential candidate to take on the far more arduous task of handling the federal government’s heavily out-of-balance budget?

What kind of message does this send to voters if Candidate O’Malley had to load himself down with IOUs to make ends meet despite a hefty family income?

To critics, it’s indicative of the kind of state government O’Malley ran, in which he repeatedly sought more and more social spending even though he was driving Maryland deeper and deeper into a sea of red ink.

By the time the Democratic governor left office, his replacement, Republican Larry Hogan Jr., said he was facing a $1.3 billion gap between spending and incoming revenue.

O’Malley was able to paper over the state’s structural deficit most years by raising taxes – dozens of fee and tax hikes. But with a family budget, you can’t turn to that kind of legerdemain.

It is entirely understandable that Mr. and Mrs. O’Malley, devout Catholics, want to give their children a solid parochial education. That costs a pretty penny in Baltimore’s private schools.

Plenty of parents make that same choice knowing it will place them behind the financial eight-ball for decades. It is a sacrifice they feel is worth the pain to ensure their kids receive quality schooling that includes religious instruction.

Digging a hole

College is a totally different matter.

The O’Malleys let their daughters select high-cost, out-of-state campuses – Georgetown and the College of Charleston. Premier institutions, no doubt.

Yet with the O’Malleys still sending two sons to parochial schools and then onto college, didn’t it dawn on them that they were digging a hole of future debt that could prove embarrassing and keep them paying off loans for the rest of their lives?

It was not a smart move financially.

The O’Malleys moved out of the Annapolis governor’s mansion in January and into a four-bedroom, 1928 house in Baltimore’s toney Homeland community they bought for $549,000. They put down $65,000 in cash and took out a whopping $494,000 mortgage, according to federal filing reports.

That brings the couple’s debt burden – education loans plus mortgage – to $833,000. If their two sons also get to select expensive out-of-state schools, the O’Malley debt loan could top $1 million.

As has been pointed out by MarylandReporter.com’s Len Lazarick in a piece last Tuesday, the former governor and District Court judge could have invested a chunk of their salaries in Maryland’s college tuition savings plan to offset higher-education expenses. If the parents had put their foot down and insisted their children attend in-state public universities and colleges, the couple probably could have paid those tuition bill out of their bank accounts.

That’s not exactly a ringing endorsement of Maryland’s four-year public institutions by a Maryland governor – even though there are numerous gems to choose from, such as St. Mary’s College, UMBC, the flagship University of Maryland College Park campus, and well-regarded schools in Frostburg, Towson and Salisbury.

Legitimate campaign issue

If Martin O’Malley eventually becomes a legitimate contender for the Democratic presidential nomination (at this point he’s being heavily outspent and out-polled by Hillary Clinton and Sen. Bernie Sanders), his questionable handling of his family‘s education finances could become a legitimate bone of contention.

Sure, our children deserve a chance to gain a high-caliber education, even it is requires the parents to dig deep into their pockets. But like everything in life, there are limits to what that sacrifice should entail.

O’Malley hasn’t used good fiscal discipline in dealing with his family’s education expenses. Does this put a damper on voters’ perception of him as a viable presidential contender?

Barry Rascovar’s blog is www.politicalmaryland.com. He can be reached at [email protected]

RELATED STORY: John Wagner of the Washington Post has more detail on O’Malley finances.

Let’s not forget the financial mishandling of Baltimore and Maryland during his tenures…

As for his family finances… Maybe he thought that we Maryland taxpayers would be taxed to bail him out… LOL !

He’s not presidential material, even remotely…

Mr. O’Malley’s apparent ignorance of basic personal finances disqualifies him from future positions of public trust, and the presidency is the ultimate position of public trust. He needs to join a 12 step program for basic budgeting.