By Barry Rascovar

For MarylandReporter.com

Raising the minimum wage is all the rage among liberal Democrats and liberal advocacy groups. Listening to them it’s clear a much higher minimum will dramatically close the income inequity gap.

Nirvana is just around the corner.

All this is well intentioned. Yes, there is a widening gulf between America’s very rich and the middle and lower classes. Yes, the nation’s minimum wage needs adjustment. Those at on the bottom of American society need extra financial help.

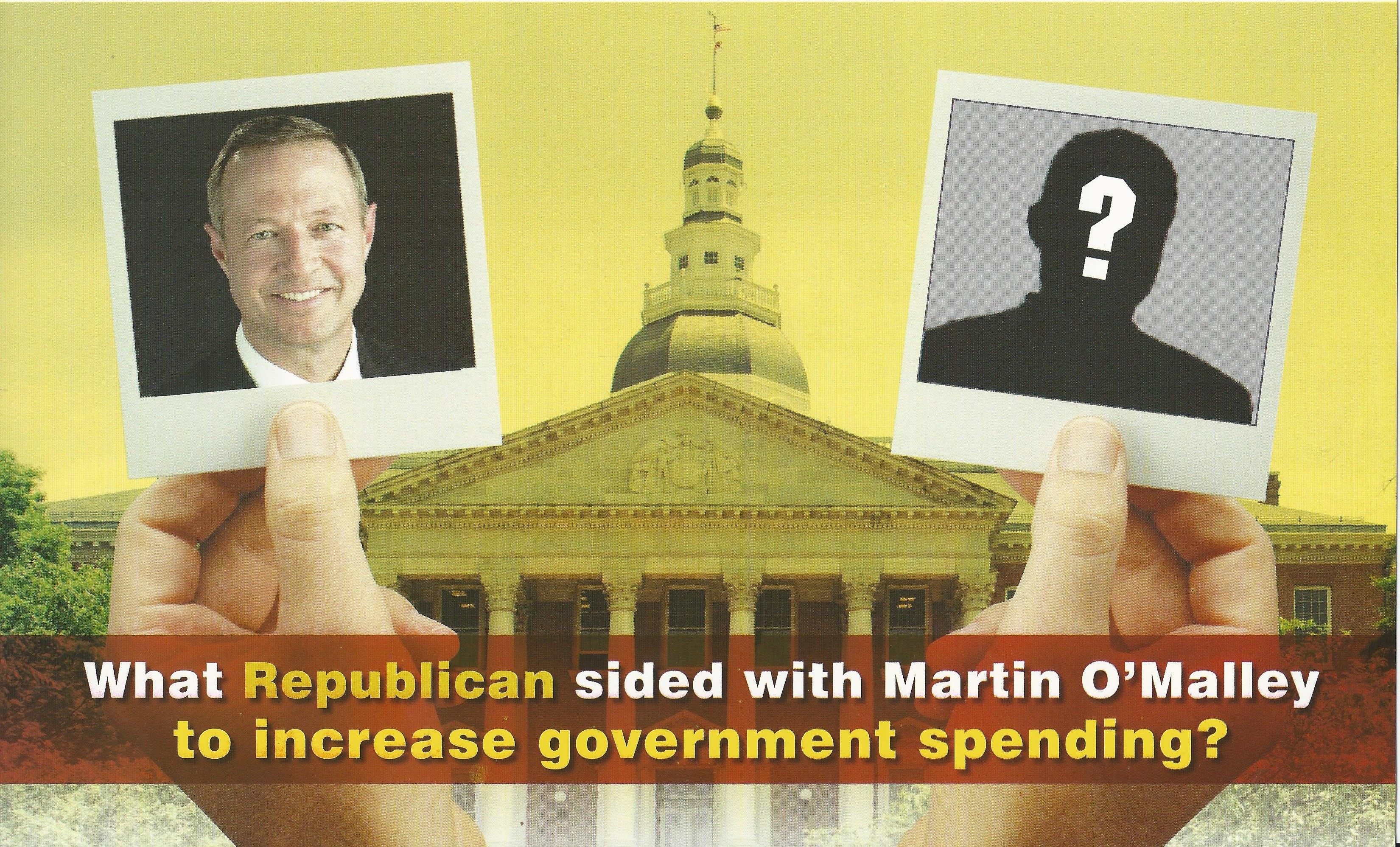

But is the nearly 40 percent jump in the minimum wage proposed by President Obama and his wannabe successor, Maryland Gov. Martin O’Malley, the solution?

Will prosperity suddenly blossom, job-growth flourish and the poor take home enough pay to cover all expenses?

Sadly, the answer is “no.”

Indeed, a rapid and steep rise in the minimum wage may result in the Law of Unintended Consequences coming into play – fewer job opportunities, layoffs, cutbacks in hours worked, higher consumer prices and more delays in business expansion.

Small business perspective

Put yourself in the position of the small business.

The owner employs mainly low-wage workers at two or three retail locations. Wages already eat up most of her revenue. Now those wages are going to rise by over a third.

Chance are this business person will take steps to curb her new overhead – letting some workers go, reducing hours for other employees and raising prices, if competition permits.

Some small businesses may be so hard hit that they can’t stay open. Even larger operations might see profits dip substantially, forcing them to put growth plans on hold.

Negative impact from doing good

Do-gooders could end up harming the very people they seek to help.

It is encouraging that House Speaker Mike Busch and Senate President Mike Miller recognize caution is required in approaching the minimum wage issue.

One size may not fit all businesses in various parts of the state.

A $10.10 minimum rate in impoverished and isolated Garrett County goes much further than in Montgomery County, but Garrett business owners may not be able to afford such a large wage boost.

Ocean City’s part-time summer employment base attracts college students, not folks looking for full-time work. Boosting their pay by nearly 40 percent doesn’t help the poor at all. It may, though, force some small entrepreneurs to close up shop.

A better method

There’s a far better way to help men and women struggling at the bottom of the economic ladder. It’s called the earned income tax credit – a targeted wage supplement that rewards the working poor.

So why isn’t O’Malley proposing a major boost in Maryland’s earned income tax credit? Because it would require him to pay for it and cut tens of millions from other agencies and programs.

It’s far easier for O’Malley – as he has done throughout his terms as governor – to beat up on the business community and demand the private sector help the poor. It becomes a private-sector burden rather than a burden on O’Malley’s budget.

There shouldn’t be a debate over raising the minimum wage gradually over a number of years. It’s too low now.

Deceptive political mindset

But liberal politicians have seized on this issue as an easy answer to the nation’s persistent slow growth. It isn’t.

They ignore the real purpose of minimum wage jobs – to get young people starter jobs so they can learn about showing up regularly and on time, to provide supplemental wages for older folks, and to assist those whose full-time jobs don’t pay all the bills.

In most cases, these positions are not for those seeking permanent employment. They are entry-level jobs.

High turnover is expected. The work doesn’t require much brain-power. The jobs are designed to be a start or a supplement, not a career.

Cautious approach needed

Attacking income inequality is far more complicated than simply doubling or tripling the minimum wage. Attacking the business community for pointing out the obvious flaws in this liberal crusade doesn’t help matters, either.

There’s little doubt O’Malley will get a modified minimum wage proposal through the General Assembly this session. Yet a slow and cautious approach is advisable.

The next group of elected Maryland officials needs to focus more on designing programs that actually stimulate and encourage economic growth.

O’Malley and his liberal followers seem to have fallen into the political trap of calling for superficial solutions that do not come close to resolving the exceedingly knotty problems confronting society.

Read other commentaries by Barry Rascovar at www.politicalmaryland.com.

I attended the Raise the Minimum Wage Rally at Saint Vincent Di Paul Church this morning. I was impressed by the cross section of religious organizations advocating for this issue. The current motto is raise the wage to $10.10. Well, I size does not fit all situations across the state equally. Each jurisdiction has different income levels from a low in Garrett County to a high in Montgomery County. The more an individual earns the more one can spend in the economy. The solution lies somewhere in re-working the Earned Income Tax Credit formula and having each jurisdiction determine their minimum wage. Thank you. Jake Mohorovic from Downtown Dundalk

It is grossly unfair to accuse Gov. O’Malley of ignoring the EITC. The refundable EITC was last raised in 2007–at his initiative and with strong support from legislative leaders like Sen. Rich Madaleno and Del. Sheila Hixson. It was and remains an excellent tool for offsetting regressive tax measures, like raising the sales tax.

In an ideal world, the EITC would be used ALONG WITH appropriate but modest adjustments to the minimum wage. The programs support each other rather than being a trade-off. But that’s not our world in 2014. Given our political realities, there’s no chance Congress will pass any changes to the EITC that would increase aid to working poor families with children.

Excellent point regarding the EIC. It is now one-half the Federal earned income credit, and could be increased to 100%, except for the reasons Rascover cites.

However, I would like to point out that fraud levels in the EIC and unemployment compensation programs are staggering, far greater than the official rates determined by the U.S. Treasury and Department of Labor, respectively. For instance, does anyone really believe that UC recipients actually contact at least three prospective employers every week? No way…but the majority

fraudulently claim they do.

Perhaps the private sector is the best place to put the burden for “fixing” income inequality. At least raising the minimum wage does not engender the astonishing fraud against these Federal programs.

What ever happened to supply and demand? If the Democrats ever stopped passing and imposing expensive taxes and fees, businesses might not avoid Maryland. We have the worst business environment in the Mid Atlantic. Most Maryland jobs are at nonprofits or federal. state and local governments. The Democrats even market the state as a nonprofit haven.

If there are no profits there are no business taxes. Therefore, most of the Democrats’ magnanimous gestures to garner votes like, offering reduced college tuition to undocumented aliens (which attracts more illegals to immigrate here and use even more of our welfare resources) raise the minimum wage, tax electricity more to pay for inefficient wind turbines, prevent fracking for gas while other states are experiencing a boom in taxes from natural gas. (Therefore they have reduced income taxes) etc. this mag amity is driving prospective profitable businesses (which do pay taxes,) away from or out of Maryland.