Many investors in the current economic situation want to know how to transfer a 401(k) to gold without incurring any penalties or fees. Use a trusted, experienced gold IRA professional to ensure that you’re adhering to IRS regulations and procedures. Here are our top two picks for the best firms to work with:

<< Click Here To Visit Goldco >> << Click Here To Visit Augusta >>

How to Transfer 401k to Gold IRA

Transferring a standard 401(k) to a gold IRA is a terrific method to protect your assets.

Despite the fact that many individuals are considering turning part of their 401(k) funds into gold, no one wants to incur the penalty associated with doing so. Before utilizing your 401(k) savings to purchase gold or silver, make sure you follow the proper steps to transfer your money and convert it without incurring any fees.

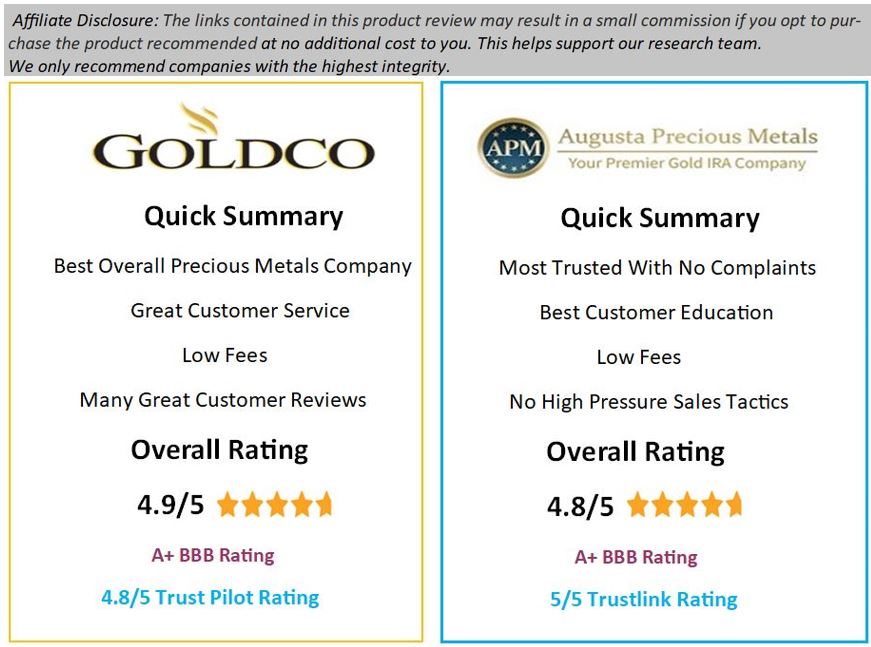

There are a few precious metals companies that specialize in gold IRA rollovers, after reviewing most of them, we have narrowed it down to our two top rated gold IRA Companies, they are:

- Goldco Precious Metals Company

- Augusta Precious Metals Company

Both of these gold IRA companies are big on client education, and they both offer a free gold IRA and precious metals investing kit, as well as many other educational materials.

#1. Goldco Precious Metals Company

<< Click Here To Get The Free Goldco Gold IRA Kit >>

Click below to read more about Goldco Precious Metals:

<< Click Here For a Full Review Of Goldco Precious Metals >>

Goldco Precious Metals – Goldco is one of the best precious metals investment companies in the business. They have a lot of positive feedback and high ratings because of their inexpensive prices and superior customer service. On TrustPilot, they have a 4.9/5 rating, and the BBB has given them an A+ rating.

#2 Augusta Precious Metals Company

<< Click Here To Visit Augusta Website >>

Click below to read more about Augusta Precious Metals:

>> Click Here For A Full Review Of Augusta Precious Metals >>

Augusta Precious Metals – Augusta is another good option for gold IRA and precious metals investing. They’re also known for their affordable fees and good reputation. Instead of using high-pressure sales methods, Augusta provides information to its customers. This company has an A+ rating with the Better Business Bureau, with an overall rating of 4.88 out of 5. The many favorable Augusta Precious Metals reviews show that Augusta operates with high client satisfaction.

401k to Gold IRA Rollover

To move your 401(k) to a gold IRA, you must do a 401(k) to gold IRA rollover. There aren’t many 401(k) programs that enable you to invest in precious metals like gold. If yours does not, you will need to roll over your 401(k) into a reputed gold IRA or self-directed/solo IRA .

It’s not difficult to transfer a 401(k) to a Roth or standard IRA. It is common for investors to do this when they leave a previous company since they desire to maintain all of their retirement funds in the same location.

It’s a good idea to diversify your retirement funds by investing in assets that are not directly related to the economy, such as precious metals because their value should remain constant regardless of the state of the economy. The easiest way to address this issue is to convert your 401(k) to an IRA with a gold rollover. To meet your specific needs, a gold IRA adviser with extensive knowledge and expertise may provide advice and help develop a retirement strategy.

Convert a 401k to Precious Metals With These Steps

Buying and selling precious metals, as well as completing the necessary documentation, are all part of the process of converting your 401k into precious metals. You will be able to convert your 401(k) into a hassle-free, smooth transfer with the help of an expert adviser who will assist you with every step of the process, managing storage facility paperwork, custodian paperwork, and so on.

So, if converting your funds into gold seems appealing, these are the procedures you must take:

- Make sure you work with an expert gold IRA provider that can assist you in learning about precious metals investment and navigating the numerous resources to get your gold IRA up and running.

- The next step is to decide on a custodian for your gold IRA account that you have complete control over.

- A new account should be opened with the custodian to buy and store gold.

- The custodian and provider will obtain the gold on your behalf if you complete the money rollover from your old account to the new gold IRA account.

An experienced IRA service provider will make the procedure as simple as possible for you.

Is Moving a 401(k) to a Gold-Backed IRA a Good Idea?

We may expect the economy to remain volatile in the near future. Gold’s value has been stable for millennia, making it an excellent hedge against financial collapse and inflationary overheating. So many Americans are worried about their possessions depreciating in value as they near retirement because the dollar appears to be losing value every day.

You may protect your hard-earned cash by investing in gold rather than relying on the ever-changing value of a single dollar. There are no fines or taxes to be paid when a 401(k) is transferred to a gold-backed IRA.

The Taxpayer Relief Act of 1997 expanded the list of assets that can be held in a self-directed IRA to include silver and gold. It was not until 1998 that palladium and platinum were included. There are four precious metals you may invest in with a self-directed IRA: platinum; palladium; gold; and silver.

Rolling your 401(k) funds into an individual retirement account (IRA) and subsequently investing in precious metals is an option if you are no longer employed by the employer with whom you originally opened the account.

You may still be able to free up money for a gold-backed IRA, though, if you are still employed by the firm. This practice is called ‘in-service distribution.’ Unlike a loan, this is a payout of funds that have been rolled into the self-directed Individual Retirement Account (Ira). Within 60 days of the transfer, there are no tax penalties for such a rollover. You should check with your 401(k) provider to see if this is allowed in your plan. If this is the case, they may be able to help you with the move.

Click on either Goldco Precious Metals or Augusta Precious Metals below to obtain your free gold IRA rollover guide, and feel free to contact either of them if you have any questions.

To obtain the free Goldco Precious Metals gold IRA guide or to contact one of their IRA experts, click the link below:

<< Click Here To Visit Goldco >>

To obtain the free Augusta Precious Metals gold IRA guide or to contact one of their IRA experts, click the link below:

<< Click Here To Visit Augusta >>

Rollover of a Self-Directed Gold IRA

You can choose to forego the 401(k) and transfer the funds to a self-directed gold IRA if your 401(k) doesn’t offer the kind of unfettered access to gold investing that meets your investment objectives. You may access almost any type of gold investment using this method, including mutual funds, ETFs, stocks, and commodities futures.

A type of individual retirement account known as a gold IRA or precious metals IRA allows participants to contribute gold coins, bullion, or other permitted precious metals.

If a 401(k) holder retires or quits their work for whatever reason, they can simply transfer the funds over into a gold IRA. To access the funds before retirement or prior to leaving the firm for another reason, an employee who has a 401(k) with a current employer should inquire with the employer about taking an “in-service withdrawal.”

There is no tax penalty if the employee reinvests the earnings within 60 days in another 401(k) plan or an IRA. Traditional IRAs normally do not permit investments in real gold, instead allowing only investments in gold equities or funds. A self-directed IRA, however, enables you to keep genuine gold rather than “paper gold” if you like. What you should do in order to convert a 401(k) plan into gold or another 401(k) is as follows:

- Decide on the new account type you choose

- Create the account

- Direct rollovers can be discussed with your former 401(k) plan’s service provider.

- Make wise investing decisions.

We can examine more closely at each of those four processes.

Selecting Your New Account

There are several advantages to doing a 401(k) rollover, including a wide range of investment alternatives and the potential to save money on fees. This means that changing your plans might be beneficial.

Roth IRA: You’ll have to pay taxes on any money you move to a Roth IRA. Withdrawals from a Roth IRA are tax-free, but contributions to the account are not.

Traditional 401(k): Traditional 401(k) rollovers are tax-free as long as the transfer is done within 60 days of the original transfer.

Traditional IRA: Traditional IRAs, like traditional 401(k)s, provide investors with a tax-deferred method of saving for retirement.

As a result, you are free to set up your own solo 401(k) or self-directed IRA to own gold or other precious metals, both of which are allowed by the government. The trustee becomes both your broker and the custodian of your gold.

If you abide by certain government regulations, you can purchase or sell gold using a 401(k) or a gold IRA. If you use a self-directed 401(k) plan or gold IRA, you can’t really hold the gold.

Sole proprietorships and self-directed retirement accounts are basically the same thing. In contrast, with a 401(k), you can contribute more money each year than you may with a self-directed Individual Retirement Account (IRA). In terms of perks and rules, they are all the same.

Opening Your New Account

An online broker or a Robo adviser can be used to set up a new Individual Retirement Account (IRA) quickly and conveniently. If you’d rather not choose your own assets, the Robo-advisor can manage a well-balanced portfolio for you.

You have even more control over your assets when you use an online broker. You will be able to choose which ones to purchase and mix and combine as you see fit. Finding a supplier who does not charge large fees is a smart idea because commissions and fees may quickly mount up. Also, choose a company that specializes in precious metals.

Discussing a Direct Rollover with Your 401(k) Plan Provider

Talk to your prior 401(k) provider about transferring your savings as well. We advise you to do this as early as possible because your provider may slow things down in order to keep you as a customer. Because the check isn’t going to you, but to your new account, you should always request a direct rollover.

You must have the funds in your new account within sixty days of it leaving your old account, or you will be subject to fines and taxes that can be rather expensive. In order to avoid fines, you should complete the rollover as quickly as possible.

If you’re planning on a direct rollover, most providers will want you to fill out a number of documents. However, the procedure might differ from provider to provider. You’ll need to get in touch with the administrator of your previous employer’s retirement plan to find out how to accomplish this. Wire transfer or cheque will be sent to your new account after they have received all of the documentation.

Indirect rollovers are also an option, although they are more difficult to execute. When you do an indirect rollover, the money gets into your account, and you must then transfer it to your IRA within sixty days.

With an indirect rollover, you run the danger of having to deal with a more complicated tax situation. If you fail to complete the rollover in time, you may be subject to fines and income tax. The fact that you must transfer the entire amount into the new account means you’ll have to utilize your personal account to make up the difference if your provider withholds 20% of the withdrawal for tax purposes.

To Get The Free Goldco Gold IRA Guide, Click The Link Below:

<< Click Here To Visit Goldco >>

To Get The Free Augusta Gold IRA Guide, Click The Link Below:

<< Click Here To Visit Augusta >>

Choosing the New Investments

After completing your rollover, you may select what to do with the money you’ve saved. Investing in index mutual funds is an option, but the real gold is another option. If you diversify your investments, you may help safeguard your portfolio from market swings.

When buying gold bullion or coins, it’s a good idea to be aware of the risks. For example, you may be required to pay storage fees or broker charges in order to store your gold. When diversifying your portfolio, you can also invest in gold through different methods.

It is possible to make a deal to buy or sell gold at an agreed-upon price in the future using gold futures and options. Because they are traded on commodity markets, these contracts are tightly controlled by the federal government

Stocks in gold mining: Gold mining and/or refining companies can also be purchased through stock investments. Be careful to conduct your homework on the company first and confirm that it is financially stable before proceeding. Gold mining mutual funds may also be purchased, which is a less dangerous option because you’re dealing with a third party that has already done the research for you.

Gold ETFs, or exchange-traded funds: ETFs are made up of a variety of different assets, such as gold options, gold futures, and real gold. ETFs, in contrast to mutual funds, can be traded at any time of the day or night, regardless of when the market shuts.

Forms of Gold Permitted by the IRS

Individual retirement accounts in the United States are only authorized to hold certain kinds of gold, according to US Code 408. The following are the rules:

- Only 99.5 percent pure gold can be used in gold coins, bars, and rounds

- Numismatic coins are prohibited.

- Non-US Gold Coins having a Purity Level of 99.9% are acceptable.

- It is not permissible to own fractional amounts of bars or coins.

- One, one-half, one-quarter, and one-tenth-ounce gold coins are permitted.

- Refineries and national government mints are the only authorized sources of gold.

IRS Requirements

For people who don’t adhere to the rules of their retirement account type, there are consequences. A 60-day time limit applies to any account transfers. It is taxed as ordinary income at the current rate on any money that has not yet been transferred to an IRS-approved retirement account. In addition, a 10% early withdrawal tax on all distribution fees is applied to everyone under the age of 59.5.

The only way to avoid paying a penalty on your 401(k) transfer is to execute it within 60 days. Rolling over 401(k) funds into an investment account that holds precious metals would be the best choice, as it would not trigger the IRS’s 60-day regulation.

IRS Storage Requirements for Gold IRAs

There must be a US bank or an IRS-approved non-bank financial entity that holds all the gold in an IRA account. You can’t keep IRA-owned precious metals at your house, office, or any other type of storage facility or personal lockup since you’re not allowed to take physical custody of the metals.

As per IRC 308(m), gold and other precious metals need to be kept in a specified manner. An IRS-approved depository (not a bank) or financial institution must hold the precious metals in an IRA, according to the guidelines.

That means that IRA-purchased precious metals can’t be held in your hands. In a self-directed IRA, it must be held by a third-party custodian.

Investing in precious metals is similar to investing in mutual funds or stocks, in that a custodian holds the metals on behalf of the investor.

The IRS has recognized a number of depository facilities for the storage of precious metals. As soon as an investor has opened a gold IRA account, they can choose the custodian for the account.

401(k) Rollovers into Gold: Some FAQs

Switching to a different retirement plan on the spur of the moment would be a huge error. While this may be a bad thing, the good news is that the funds may be easily converted to gold IRAs within minutes. What are the most often asked questions regarding the process?:

Q: Is it possible to put money from my 401(k) into gold?

Yes, before you get started, read this advice completely and make sure you’re working with a reliable organization.

If I transfer a 401(k) to a gold IRA, would I have to pay any taxes?

The only exception is if you don’t follow the instructions precisely while performing a 401(k) rollover.

Q: Do I have to pay taxes if I buy gold?

Investments and contributions to traditional 401(k) and IRA plans are tax-deferred, so no taxes are due on them. The only tax you’ll owe is on the withdrawals you make when you’ve saved up enough money. Those who acquire gold for the sake of it must pay taxes if they do not do it through a 401(k) rollover.

Is it feasible to use my 401(k) to buy actual gold?

Even while it is possible to invest in gold through your 401(k), this process might be tricky since your IRA cannot serve as both supplier and buyer. Because you aren’t authorized to keep your own actual precious metals, precious metals firms and banks must store them with a third party.

In order for your 410(k) plan to store actual gold, someone else must take care of the storage. Because of security concerns, you can’t keep it with you at all times.

Is a rollover of an IRA subject to tax?

If the rollover is done correctly, the money will retain its tax-deferred status and there will be no penalties or taxes to pay. If the rollover process takes more than 60 days, you will be penalized by the IRS.

If you withdraw your money early, you will be hit with a 10% penalty as well as a tax charge (before you are 59.5 years of age). However, if you complete the transfer within 60 days, you can avoid this.

If you choose an indirect rollover, you must be at least 59.5 years old and the new account must also be a tax-deferred plan in order to avoid fines.

In summary,

If you want to protect your retirement savings, you might consider converting your 401(k) plan to a gold IRA. With no penalties, you may easily convert your qualifying 401(k) to gold. In the event that present geopolitical uncertainty continues, tax-advantaged money can be used to purchase actual precious metals as a hedge against inflation and economic unrest.

Throughout history, gold and other precious metals have been shown to gain in value or at least hang on to their worth when other forms of assets have lost their value, thereby providing the type of portfolio balance that will help you protect your money over the long run.

Taking part of your money out of the volatile markets and investing it in gold is a wonderful idea right now. There is no penalty for moving your 401(k) into gold with any of the businesses we recommend (Goldco Precious Metals or Augusta Precious Metals). You can check them out below:

To Get The Free Goldco Gold IRA Guide, Click The Link Below:

<< Click Here To Visit Goldco >>

To Get The Free Augusta Gold IRA Guide, Click The Link Below:

<< Click Here To Visit Augusta >>

Affiliate Disclosure:

The links contained in this product review may result in a small commission if you opt to purchase the product recommended at no additional cost to you.

Recent Comments