Tag: Affordable Care Act

DeMarco: Biden’s proposal to make enhanced A...

By Bryan Renbaum | April 29, 2021 | News | 0 |

DeMarco highlights health care policy goals for th...

By Bryan Renbaum | December 9, 2020 | General Assembly | 0 |

Marylanders with pre-existing conditions will be p...

By Bryan Renbaum | October 6, 2020 | General Assembly, News | 0 |

Maryland’s elected officials urge the state&...

By Bryan Renbaum | July 8, 2020 | COVID-19, News | 0 |

Frosh defends ACA’s birth-control coverage m...

By Regina Holmes | April 8, 2020 | News | 0 |

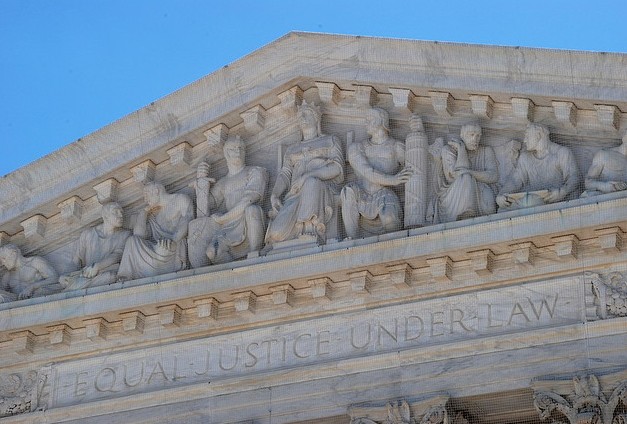

DeMarco: Affordable Care Act is ‘here to stay’ following recent US Supreme Court ruling

by Bryan Renbaum | June 18, 2021 | News | 0 |

With the U.S. Supreme Court now having rejected three legal challenges to the Affordable Care Act (ACA), former President Barack Obama’s signature health care law is likely to remain codified in statute forever, one of Annapolis’ most well-known health care lobbyists said Friday.

Read MoreDeMarco: Biden’s proposal to make enhanced ACA premium subsidies permanent is a ‘game changer’

by Bryan Renbaum | April 29, 2021 | News | 0 |

Maryland Citizens’ Health Initiative President Vincent DeMarco said President Joe Biden’s proposal to make enhanced Affordable Care Act (ACA) premium subsidies provided through the American Rescue Plan Act permanent would, if implemented, be a “game-changer” for millions of Americans and hundreds of thousands of Marylanders with regard to health care affordability.

Read MoreDeMarco highlights health care policy goals for the upcoming legislative session

by Bryan Renbaum | December 9, 2020 | General Assembly | 0 |

MarylandReporter.com spoke with Maryland Citizens’ Health Initiative President Vincent DeMarco this week about his group’s three main policy goals for the upcoming legislative session: making prescription drugs more affordable, protecting and building on the Affordable Care Act, and promoting health equity. The 2021 legislative session is scheduled to begin on Wednesday, January 13.

Read MoreMarylanders with pre-existing conditions will be protected regardless of how SCOTUS rules on Obamacare

by Bryan Renbaum | October 6, 2020 | General Assembly, News | 0 |

Even if the U.S. Supreme Court rules that the Affordable Care Act (ACA or Obamacare) is unconstitutional Marylanders with pre-existing health conditions will still be protected under a state law that went into effect on Oct. 1.

Read MoreMaryland’s elected officials urge the state’s uninsured to take advantage of extended open enrollment period

by Bryan Renbaum | July 8, 2020 | COVID-19, News | 0 |

@BryanRenbaum Members of Maryland’s congressional delegation teamed up with state lawmakers...

Read MoreFrosh defends ACA’s birth-control coverage mandate

by Regina Holmes | April 8, 2020 | News | 0 |

Maryland’s attorney general files an amicus brief in a Supreme Court case to defend mandated contraceptive coverage under Obamacare.

Read MoreMd. health insurers want 28% rate hike; consumers face agonizing choices

by Charlie Hayward | August 30, 2016 | News | 1 |

Consumers who aren’t covered by employer insurance plans, or earn too much to qualify for Medicaid, will face steep premium increases in the Individual (or Indy”) Market averaging 28% higher than last year under the Affordable Care Act, if the Maryland Insurance Administration approves the proposed hikes.

Read MoreStakes are high in U.S. Senate race, Van Hollen says

by Len Lazarick | January 18, 2016 | Uncategorized | 0 |

“The stakes are very high” in this race for the seat Sen. Barbara Mikulski is retiring from, Van Hollen told the Columbia Democratic Club. “There is no way Democrats win back the U.S. Senate without winning the Maryland senate seat. We cannot take anything for granted.”

Read MoreRascovar column: Maryland’s Obamacare fiasco continues

by Maryland Reporter | March 2, 2014 | General Assembly, News | 6 |

How high will it go? How much more will it cost the O’Malley-Brown administration to fix or totally replace the dysfunctional online health insurance system that it bragged about until the software crashed on Day One?

It already is the most costly debacle in state history.

Read MoreMany Marylanders still optimistic about health care reform, poll finds

by Len Lazarick | November 7, 2013 | News | 2 |

Almost half of Marylanders still think the new health care law will have a positive impact on the quality of health care in Maryland, a new Goucher poll found. But only half of those surveyed said they had heard of the website MarylandHealthConnection.gov, the state’s access portal for health insurance.

The respondents also believed the insurance companies were the most prepared to handle the implementation of the health insurance reform and the federal government was the least prepared.

Read MoreMd. officials count undocumented immigrants as uninsured for health care, but none qualify for Obamacare

by Len Lazarick | October 21, 2013 | News | 13 |

State officials have been talking a lot about the high number of uninsured Marylanders who will have access to Obamacare, but not all are eligible to sign up.

Of the state’s estimated 750,000 to 800,000 uninsured residents, only 480,500 — or roughly 60% — are eligible to enroll for health insurance plans under President Obama’s signature health care law, according to the federal health care website HealthCare.gov.

Western Md. health exchange finds paper trail around Obamacare glitches

by Len Lazarick | October 11, 2013 | News | 0 |

One of Maryland’s six health care groups contracted to enroll Marylanders in Obamacare health insurance plans has found a way around computer glitches the state has been experiencing since the health insurance exchange opened Oct. 1 — they’re going back to paper.

Healthy Howard, which services residents of six Western Maryland counties, has only been able to complete enrollment on the computer system for five people since the exchange opened. After being open one week, the state had enrolled only 326 people through its site.

Read More

Support Our Work!

We depend on your support. A generous gift in any amount helps us continue to bring you this service.

Recent Comments