Category: News

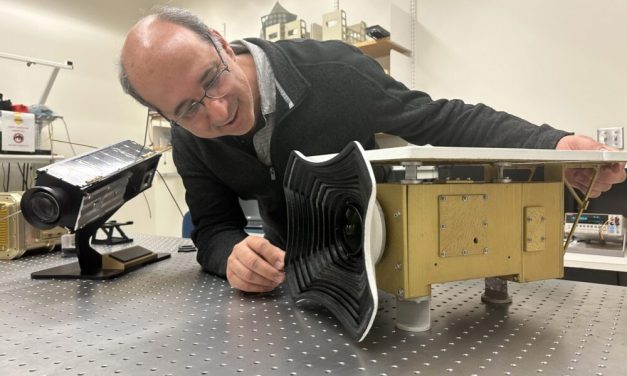

Maryland team on NASA project to examine ocean, at...

By Capital News Service | April 24, 2024 | News | 0 |

5 Places to Appreciate Nature in Maryland This Ear...

By Capital News Service | April 22, 2024 | News | 0 |

Maryland Starbucks unionizes days before a Supreme...

By Capital News Service | April 19, 2024 | News | 1 |

After two deadly work zone crashes, Maryland offic...

By Capital News Service | April 17, 2024 | News | 0 |

Top salvage, engineering firms tapped to salvage K...

By Capital News Service | April 16, 2024 | News | 0 |

Maryland governor hopeful of GOP support for Key Bridge clean-up

by Capital News Service | April 24, 2024 | News | 0 |

Gov. Wes Moore said he has met with several Republicans in Congress to discuss federal support for the response to the Francis Scott Key Bridge collapse and that they have been “incredibly encouraging” about their support for the clean-up effort.

Read MoreMaryland team on NASA project to examine ocean, atmosphere

by Capital News Service | April 24, 2024 | News | 0 |

Scientists can use PACE’s data, which was first released on April 11, for both short-term monitoring and long-term climate change analysis, according to Werdell. PACE is set to send data back to Earth 12 to 15 times every day.

Read More5 Places to Appreciate Nature in Maryland This Earth Day

by Capital News Service | April 22, 2024 | News | 0 |

Earth Day is an annual holiday that celebrates the Earth and raises awareness about the need to protect the environment.

Read MoreMaryland Starbucks unionizes days before a Supreme Court case on labor rights

by Capital News Service | April 19, 2024 | News | 1 |

Workers at the Shipley’s Grant Starbucks cafe voted to unionize this week, just days ahead of a Supreme Court case involving the company’s challenge of a federal labor injunction.

Read MoreAfter two deadly work zone crashes, Maryland officials press for change

by Capital News Service | April 17, 2024 | News | 0 |

Beginning January 2025, fines shift to a tiered system ranging from $60 to $500 depending on the driver’s speed. Fines will double if workers are present at the time of the violation.

Read MoreTop salvage, engineering firms tapped to salvage Key Bridge, open port

by Capital News Service | April 16, 2024 | News | 0 |

To remove the massive wreckage of the Francis Scott Key Bridge, state and federal authorities have brought in an elite group of contractors, ranging from a construction firm in Stockholm, salvage firms from Florida and New Jersey and a disaster management firm from Houston.

Read MoreBaltimore Port closure creates uncertainty for businesses

by Capital News Service | April 11, 2024 | News | 0 |

The magnitude of the Francis Scott Key Bridge collapse and the closure of the Port of Baltimore is beginning to sink in for a variety of business owners in Baltimore, such as Nicholas Johnson from Su Casa Furniture in Fells Point.

Read MoreMore than 1,000 small businesses seek aid amid Baltimore Port closure

by Capital News Service | April 10, 2024 | News | 1 |

More than 1,000 small businesses have sought emergency federal loans to stay afloat following the March 26 collapse of the Francis Scott Key Bridge and closure of much of the Port of Baltimore, according to the U.S. Small Business Administration.

Read MoreMaryland congressional delegation confident of bipartisan backing for Key Bridge funds

by Capital News Service | April 9, 2024 | News | 0 |

By KATHARINE WILSON Capital News Service WASHINGTON – The Maryland congressional delegation...

Read MoreMaryland’s labor shortage may mean a lack of skilled workers for the Key Bridge rebuild

by Capital News Service | April 9, 2024 | News | 0 |

Despite Maryland’s low unemployment rates, employers are struggling to fill job vacancies and the workforce’s blue-collar sector is especially stressed.

Read MoreBiden pledges to ‘move heaven and earth’ for speedy Key Bridge rebuild

by Capital News Service | April 6, 2024 | News | 0 |

President Joe Biden pledged Friday to fight for federal funding to rebuild the collapsed Francis Scott Key Bridge, promising to “move heaven and earth” during a Friday visit to the disaster site.

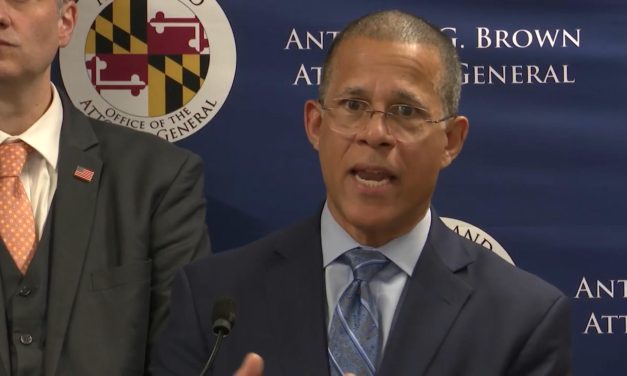

Read MoreMaryland Attorney General Anthony Brown announces a string of convictions in vulnerable adult abuse cases

by Capital News Service | April 5, 2024 | News | 0 |

Three cases of vulnerable adult abuse at the hands of caretakers have been uncovered in Anne Arundel, Howard, and Baltimore counties. Today, Attorney General Anthony Brown, the Medicaid Fraud and Vulnerable Victims Unit , and the AARP announced a plan for legislation to give the MFVVU more funding to uncover more cases of vulnerable adult abuse.

Read More

- 1

- ...

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- ...

- 325

Support Our Work!

We depend on your support. A generous gift in any amount helps us continue to bring you this service.

Recent Comments