By Len Lazarick

Len@MarylandReporter.com

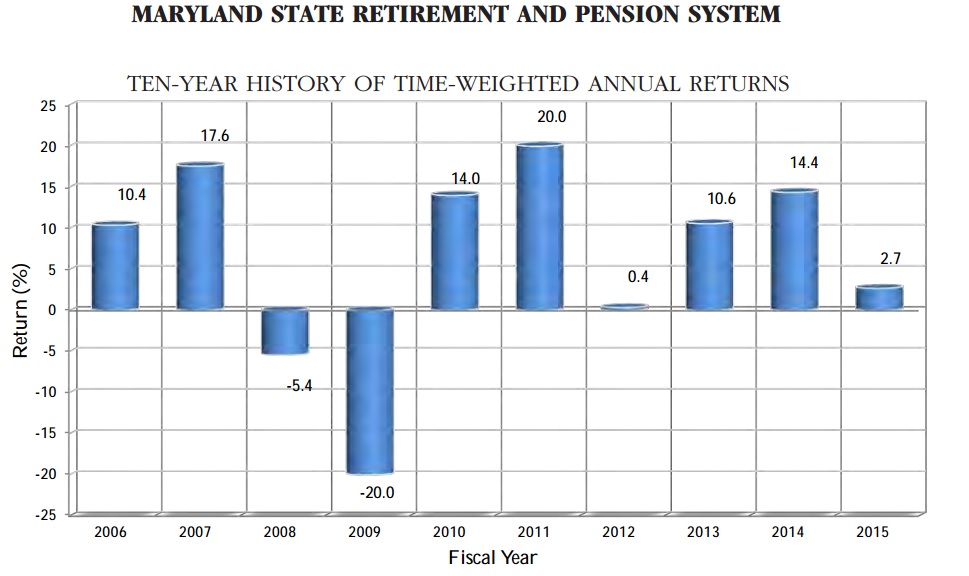

For the second year in a row, Maryland’s pension fund missed its target for return on its investment portfolio by a wide mark, earning just 1.16% for the 2016 fiscal year that ended June 30 compared to its annual goal of 7.55%. Last year, the fund made 2.68%.

Because of the lagging returns the $45.5 billion fund is apparently worth $300 million less than it was worth June 30 last year, and long-term liabilities are up over $20 billion. To match the pension promises made to state employees and teachers when the fund fails to meet investment goals, either the state or its employees must put more money in the fund, or benefits would have to be reduced in the long term.

In a press release, State Treasurer NancyKopp, chair of the Board of Trustees for the Maryland State Retirement and Pension System, underplayed the poor performance.

“While this is a very disappointing one-year return,” Kopp said, “it’s important to remember that we are long-term investors, meaning we should not be distracted by a single-year’s performance, whether the earnings are high or low. Over the last 30 years, including both good years and bad, the fund has earned an average return of 8%.”

Kopp had to reach back 30 years in order to capture the strong investment returns of the 1980s. The average investment returns for shorter periods look much worse, and none in the past 20 years come close to meeting the target of 7.55%.

5 year return: 5.68%

10 year: 4.85%

20 year: 6.08%

25 years: 7.18%

30 years: 8.0%

“FY 2016 was a second difficult year for investors,” said Andrew Palmer, chief investment officer of the Maryland State Retirement Agency (MSRA). “Unlike FY 2015 where asset returns were broadly low, FY 2016 had returns that were low on average but displayed much larger variability among asset classes. MSRA’s balanced asset allocation helped us earn modest positive returns.”

FY 2016 Performance by Asset Class

| Asset Class | Allocation | Return |

| Public Equity | 37.4% | -4.31% |

| Private Equity | 9.2% | 9.94% |

| Rate Sensitive | 22.7% | 9.34% |

| Credit/Debt | 9.4% | 2.23% |

| Real Assets | 12.7% | -1.66% |

| Absolute Return | 8.6% | -3.01% |

| Total | 100% | 1.16% |

Maryland still performed better than some large funds. Wilshire Trust Universe Comparison Service® (Wilshire TUCS®), a widely accepted benchmark for the performance of institutional assets, last week reported an average one-year gain of 0.91% for all funds. Wilshire saw an average 1.11% return for foundations and endowments with assets greater than $500 million

The California Public Employees’ Retirement System (CalPERS) with assets of $301 billion reported a 0.61% percent net return on investments for the fiscal year.

The Maryland State Retirement and Pension System administers benefits for more than 148,000 retirees and beneficiaries as well as the future benefits for more than 246,000 active and former members, including employees of many smaller counties and municipalities in Maryland.

Just hope income taxes will not be raised should Tresurer Kopp’s irrational exuberance not pan out.

The Federal Reserve’s interest rate policy is the primary cause for poor pension-fund returns nationally, as well as Maryland’s godawful performance ln the latest data relative to its 7.55% benchmark. While the 7.55% goal is unrealistic (and should be adjusted downward) the effect of any downward adjustment would be political because lowering the assumed rate of return raises the state’s actuarially-required cash contributions into the system, leaving fewer resources for state government’s programs and administration. Treasurer Kopp will explain away sub-par performance by every half truth possible because a fulsome analysis is politically toxic.

Yes, the Fed is actively squeezing all of the savers in the economy to prop up the real estate market. And they seem to dream that corporate America will take on more projects because the cost of borrowing has dropped a few percentage points.